Connecticut Faces Uphill Battle For State Child Tax Credit as Debate Continues Over Funding and Benefits

Audio By Carbonatix

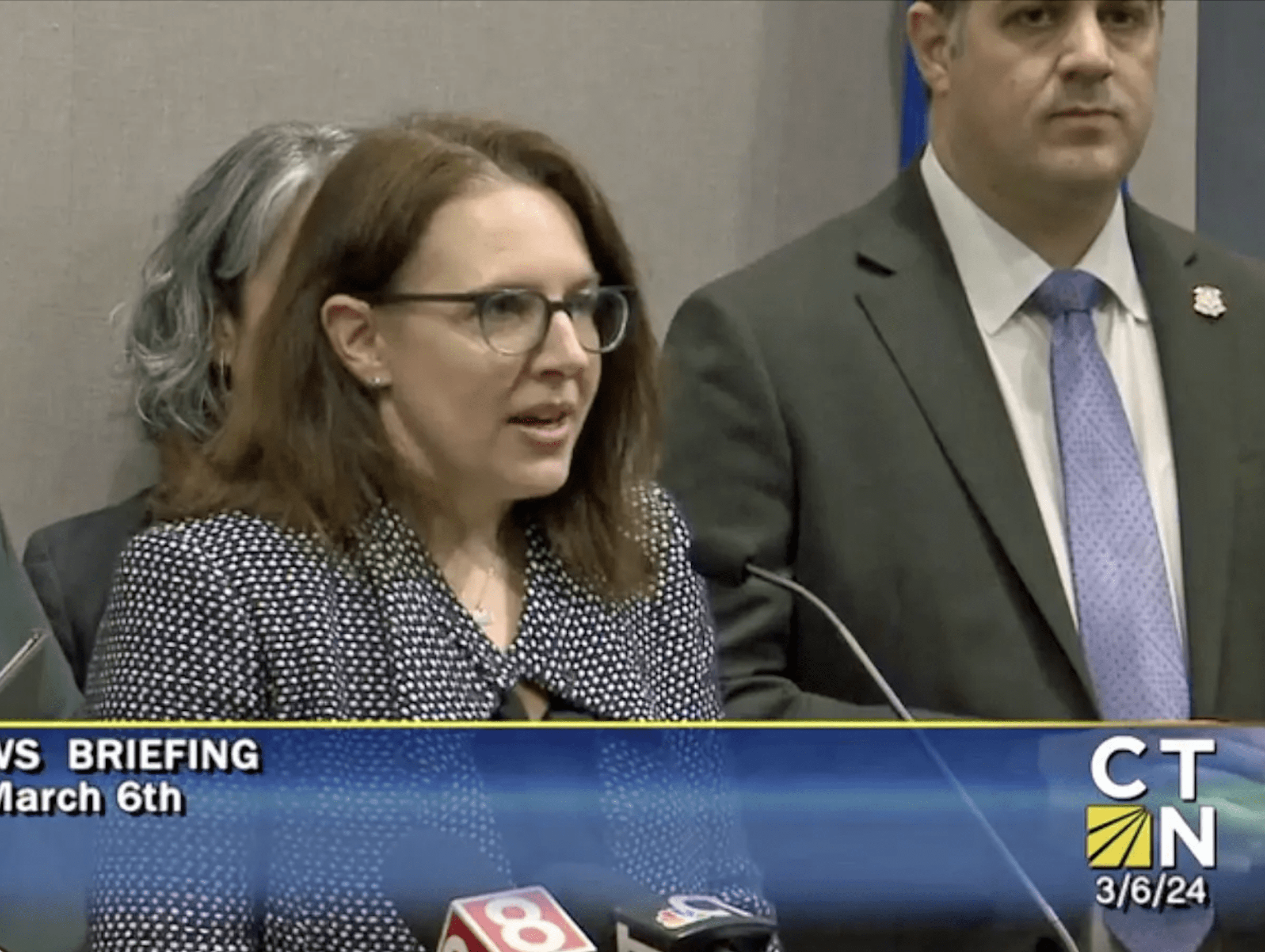

Rep. Kate Farrar, D-West Hartford, describes the need for a Child Tax Credit in Connecticut during a news conference Wednesday, March 6, 2024, at the Legislative Office Building in Hartford. Credit: Screengrab / CT-N (Courtesy of CTNewsJunkie

State Rep. Kate Farrar (D- West Hartford, Newington) held a press conference on Wednesday prior to the Finance, Revenue and Bonding Committee Public Hearing to underscore the urgent need for a permanent refundable child tax credit in Connecticut.

By Christine Stuart, CTNewsJunkie.com

It’s been an uphill battle for supporters of a state-based child tax credit and nothing has changed to indicate it’s going to get any easier.

Supporters like Rep. Kate Farrar, D-West Hartford, said the child tax credit is “a permanent and proven way to support our families, to support our economy, to close the gaps on child poverty and to create a fair tax system.”

In a statement, Farrar said, “Too many Connecticut families are struggling due to the high costs of living and our upside-down tax code. Every family should be able to provide for and care for their children. A child tax credit is a proven way to reduce child poverty, strengthen our economy and create a fairer tax system.”

Like what you see here? Click here to subscribe to We-Ha’s newsletter so you’ll always be in the know about what’s happening in West Hartford! Click the blue button below to become a supporter of We-Ha.com and our efforts to continue producing quality journalism.

[…] United Way of Connecticut indicates that 75% of households with children would benefit and can avail of the Child Tax Credit 2024, translating to $306 million […]