Consumer Diary: Tax Law Changes for 2024

Audio By Carbonatix

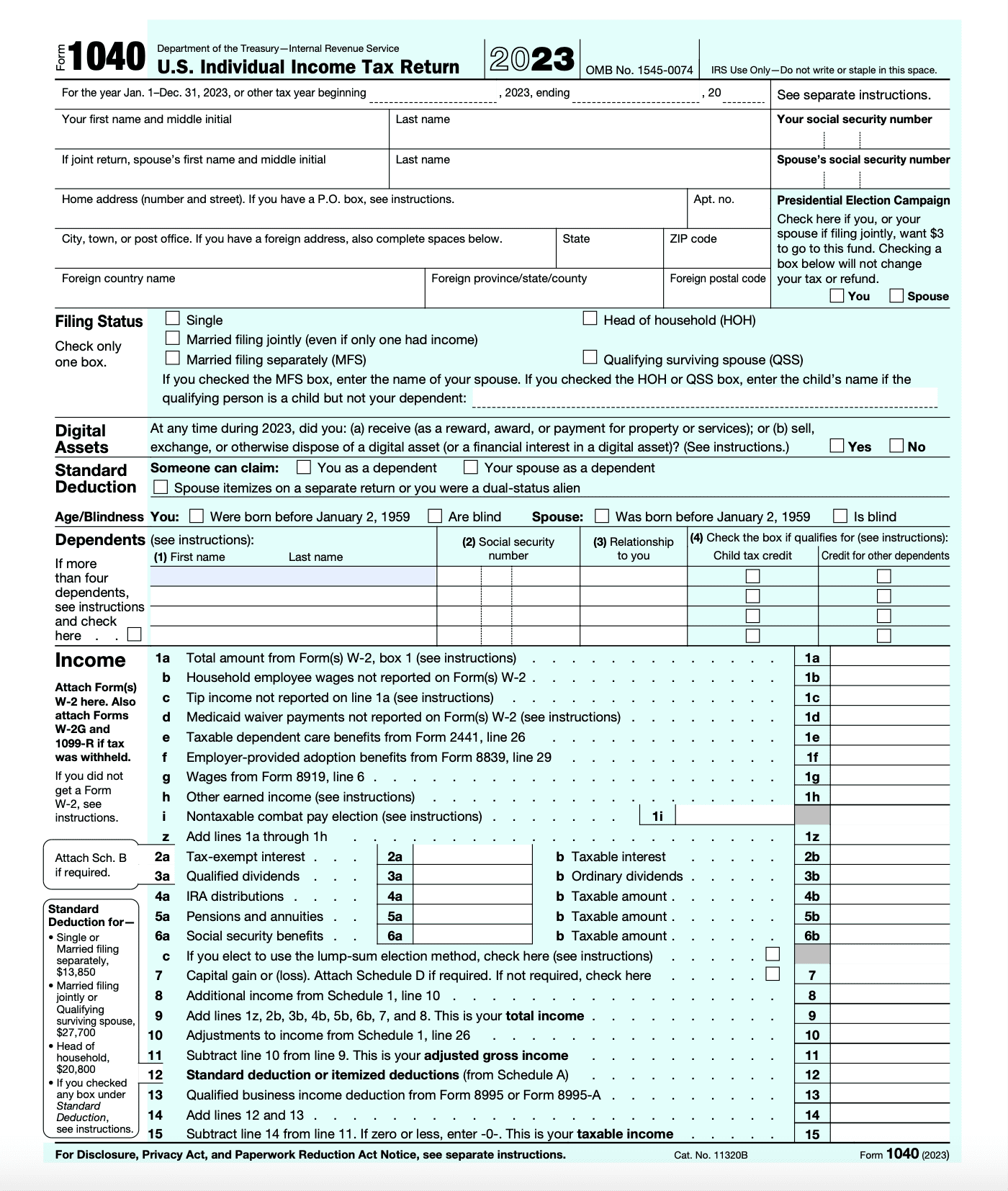

Form 1040. IRS.gov

Consumer columnist and West Hartford resident Harlan Levy has more than 20 years of experience writing stories about everyday experiences that anyone could encounter.

Harlan Levy. Courtesy photo

By Harlan Levy

I know this column will bore the life out of some readers, but I think you need to know about major tax law changes – and unchanged regulations – for 2024.

The facts, according to the Internal Revenue Service website, irs.com, and IRS spokesman Raphael:

- Standard Deduction: For 2024, the standard deduction has been raised to $14,600, up $750 from 2023. For those married and filing jointly, the standard deduction has risen to $29,200, up $1,500 from 2023.

- Child Tax Credit: Currently the maximum is $2,000 for each child – with $1,600 of that being refundable. The CTC remains the same for 2024 unless Congress approves currently stalled legislation that would increase the refundable amount to $1,800 for 2023 taxes. In tax years 2024 and 2025, the refundable amount would rise to $1,900 in 2024 and $2,000 in 2025. Don’t hold your breath.See irs.gov/pub17 for more details. NOTE “Refundable” vs. “Non-refundable”– Nonrefundable tax credits can only pay off your taxes. Any extra credit isn’t returned. Refundable tax credits pay off your taxes. You get the difference if the credit amount is more (the refund).

- Earned income credit: A refundable tax credit for low- to middle-income workers. For 2023 tax returns filed in 2024, the credit ranges from $600 to $7,430, depending on tax filing status, income, and number of children. Taxpayers without children can qualify for a lower credit amount. For tax year 2024 (taxes filed in 2025), the EIC will range from $632 to $7,830, depending on your filing status and number of children.

| Number of children | Maximum earned income tax credit | Max AGI, single or head of household filers | Max AGI, married joint filers |

| 0 | $632 | $18,591 | $25,511 |

| 1 | $4,213 | $49,084 | $56,004 |

| 2 | $6,960 | $55,768 | $62,688 |

| 3 or more | $7,830 | $59,899 | $66,819 |

See irs.gov for more information on the investment income cap, age, and special rules (If you’re separated, a soldier, clergy, those with disability income or children with disabilities, stepchildren, adopted children, etc.).

- Clean Energy credits and deductions: No change for 2024 for qualifying purchases for tax years 2023 to 2032: 30% of eligible expenses with a $1,200 annual credit limit for buying energy-efficient doors or windows and a $2,000 annual credit limit for heat pumps, biomass stoves or boilers. For what qualifies and specific details visit irs.gov news and announcements and click on “clean energy credits and deductions.”

- Electric Vehicle credits: Fewer cars and trucks qualify for the non refundable credits – up to $7,500 – in 2024. And, instead of waiting for it until you file, you can get the cash at time of purchase, to be used for a down payment or to reduce the loan. The IRS will pay the dealer back. The amount depends on where the EVs are made, where their battery components and minerals originate, their cost, and the buyer’s annual income

To qualify for EV credits:

1: The EV must be manufactured in North America and have an MSRP below $80,000 for an SUV and $55,000 for a sedan, wagon, or hatchback.

2: To qualify for the first $3,750, some of the EV’s battery components must be produced or assembled in North America. To get another $3,750 a portion of the critical minerals in the EV battery must be mined or processed in the U.S.

3: If you got your new EV in 2023, you had 34 models to choose from. So far this year, there are only 20. Which vehicles qualify in 2024? Go to energy.gov and search for “new and used clean vehicle tax credits.”

Now you know.

NOTE: If you have a consumer problem, contact me at [email protected], and I’ll try to help.

Like what you see here? Click here to subscribe to We-Ha’s newsletter so you’ll always be in the know about what’s happening in West Hartford! Click the blue button below to become a supporter of We-Ha.com and our efforts to continue producing quality journalism.