Prepared Food Tax will Hit Consumers Harder than Lawmakers Thought

Audio By Carbonatix

Connecticut State Capitol. Photo credit: Ronni Newton (we-ha.com file photo)

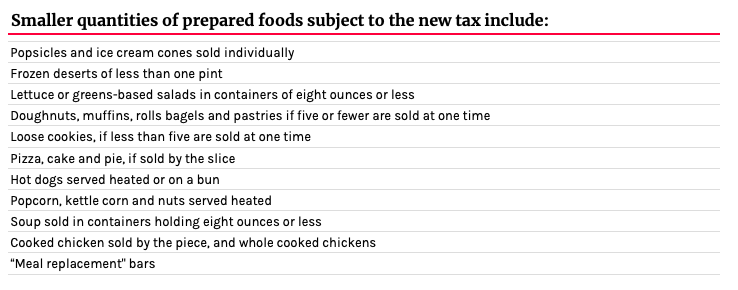

The Department of Revenue Services released a list of the foods that will be impacted by the tax hike, which goes into effect Oct. 1, and it was much more extensive than many legislators anticipated.

By Keith M. Phaneuf, CTMirror.org

A controversial tax hike on prepared foods will hit Connecticut shoppers much harder than legislators thought, raking in $158 million over this fiscal year and next – nearly 40% more than lawmakers anticipated.

That’s according to a new revenue forecast Friday from nonpartisan analysts that also shows the tax hike will collect more than $90 million annually from consumers by the 2020-21 fiscal year.

Minority Republicans in the Senate and House asked the Office of Fiscal Analysis on Thursday to revise revenue projections after the Department of Revenue Services (DRS) released guidelines showing the tax would hit a much broader range of products than many lawmakers anticipated.

“I think this is egregious behavior by the Democrats,” said Senate Minority Leader Len Fasano, R-North Haven, referring to the sales tax surcharge on prepared foods enacted last June by the legislature’s Democratic majority and signed by Gov. Ned Lamont, also a Democrat. “For the elderly, for the single mom, for the people struggling every day, this is going to tax them to death.”

Fasano and Deputy House Minority Leader Vincent Candelora, R-North Branford, disclosed the DRS guidelines at a press conference Thursday.

The tax hike was described – when legislators adopted a new state budget in early June – largely as a 1% surcharge on restaurant food or on “prepared meals.” In other words, someone who purchased a grinder and small soda combination, even at a supermarket, would pay 7.35% sales tax, rather than the base rate of 6.35%.

Yet when DRS released a policy statement this month instructing retailers on how to apply the new tax, which takes effect Oct. 1, it covered a much wider range of prepared foods.

CTMirror.org

Both Fasano and Candelora also said that while nonpartisan analysts responded quickly with a revised estimate of the impact on consumers, they fear it might be conservative.

Connecticut retailers likely will be very diligent in applying the tax to any item that might be interpreted as prepared foods “when you have the grim reaper of DRS standing over your shoulder,” Candelora said.

Neither Lamont’s office nor Democratic legislative leaders immediately commented Friday on the new projection from the Office of Fiscal Analysis.

But Democrats have said Republican criticisms of the budget are unfair, given that the GOP offered no plan of its own last spring.

Democratic lawmakers and Lamont averted a multi-billion-dollar projected deficit in the two-year budget without increasing income tax rates, but Democrats said that meant making many tough decisions.

“Governor Ned Lamont partnered with Democrats in closing a massive $3.7 billion deficit without increasing tax rates while ensuring that the safety net remains intact for the most vulnerable in our communities,” said Lamont spokesman Max Reiss. “That is a task that House and Senate Democrats, as well as the governor took seriously, as they provided proposed balanced proposals and collaborated on a final spending plan. Republicans are complaining about a budget, yet they refused to provide an alternative to keep Connecticut communities whole.”

Reprinted with permission of The Connecticut Mirror. The author can be reached at [email protected] .

Like what you see here? Click here to subscribe to We-Ha’s newsletter so you’ll always be in the know about what’s happening in West Hartford!