Town Manager: West Hartford Grand List Shows ‘Modest Growth’

Audio By Carbonatix

West Hartford Town Hall. Photo credit: Ronni Newton

The Town of West Hartford has finalized its 2020 Grand List, which indicates an overall increase of 0.44% over the previous year for the value of real property, business personal property, and motor vehicles as of Oct. 1, 2020.

West Hartford Grand List breakdown as of Oct. 1, 2020, according to class.

By Ronni Newton

The 2020 Grand List submitted to Town Manager Matt Hart this week by Director of Assessments Joseph Dakers indicates an increase in real property and motor vehicle values, combined with a decrease the value of personal property, representing an overall increase of 0.44% in comparison to 2019 values.

The Town of West Hartford Grand List of taxable and exempt property effective Oct. 1, 2020 was finalized in accordance with Connecticut General Statutes and reflects all changes in ownership and valuation – but does not reflect any revisions which may be made by the Board of Assessment Appeals. The net assessed value of all taxable property totals $6,396,112,211, an increase in the net taxable list of $27,783,867.

“The Grand List has increased by 0.44% this year, similar overall to 2019,” Hart said. “While this represents modest growth, it is encouraging to see that our housing market remains strong during the course of the pandemic. We’re looking forward to some exciting developments in the future as our larger economy continues its recovery,” he added,

“West Hartford continues to see new commercial construction and remodeling projects all around town. The real property list increased by $11,507,391 or 0.2%,” Dakers said.

Mayor Shari Cantor noted continued development of the Townhomes at Ringgold Estates as well as the proliferation of renovation projects across the community as key factors in the real property increase. “With more people working from home as a result of the pandemic, West Hartford has become an even more desirable community for homeowners and the real estate market is doing very well,” she said.

In his report, Dakers also noted that three parish houses have gone from being exempt to taxable, which has also added to the increase in real property value. A shortage of building materials due to the disruption of the supply chain caused by the pandemic, however, “has to some degree, adversely affected our Grand List growth,” Dakers said.

While the total vehicle count was down as of Oct. 1, 2020, the Motor Vehicle list increased by $17,440,747 or 4.0%.

“The increase in used car values, driven by increased demand nationally, contributed significantly to the increase in this component of the list,” the town said in a news release.

Overall, the vehicle count is down by 1,937 vehicles to 44,811 according to the town. Town records indicate that over the past 10 years there are on average roughly 47,000 registered vehicles.

Town staff said the apparent decrease in numbers is likely due to the decision by the Department of Motor Vehicles (DMV) to extend registration renewals and the department’s temporary 90-day closure earlier in the year, both due to COVID-19. Any amended numbers will be reflected in a supplement to the Grand List.

The Personal Property list decreased by $1,164,271 or 0.57%. The decrease has been attributed to some business closures, which have outnumbered new business openings. There are currently 2,719 businesses registered in town, according to Dakers’ report.

“Unfortunately, the pandemic has adversely impacted a number of our businesses, particularly restaurants and some other retail,” Hart said. “However, other business sectors, such as home renovation services, are holding strong.”

West Hartford’s highest taxpayer remains Blueback Square Holdings LP, valued at $$72,863,120, followed by Westfarms (valued at 52,480,250) and Connecticut Light & Power (now Eversource) valued at $48,002,100.

Other top-10 taxpayers are the Corbin’s Corner property at 1459 New Britain Ave., valued at $42,378,420); SF West Hartford Property Owner LLC (The Corbin Collection) at 1445 New Britain Ave., valued at $29,271,060; Town Center West Associates (29 South Main St.) valued at $28,178,400; McCauley Center Inc., valued at $24,529,330; Steele Road LLC (243 Steele Rd.) valued at $23,517,960; BFN Westgate LLC (1248 Farmington Ave.) valued at $20,510,450; and Delamar West Hartford, LLC valued at $19,285,000.

The only change to the order of the list from last year is the addition of the Delamar as No. 10, replacing Bishops Corner E&A LLC (2523 Albany Ave.) which is no longer one of the town’s top 10 taxpayers.

In 2020, the Grand List had increased by 0.82%, the greatest jump in values in a decade outside of a revaluation year. In 2019, the Grand List increased 0.43%, and the previous year the increase was 0.778%.

The Grand List is just one component of the town’s budget – the first step in the process of determining the mill rate for the upcoming fiscal year. The current mill rate is 41.8 mills for real and personal property as well as for motor vehicles.

The complete Grand List as of Oct. 1, 2020 is provided below as a PDF.

West Hartford’s budget for 2021-2022 (FY22) is scheduled to be submitted to the Town Council on March 9, 2021, and adopted on April 26, 2021.

The town’s next revaluation is scheduled to take take place during FY22 and be implemented in the following year, reflecting the value of the Grand List as of Oct. 1, 2021.

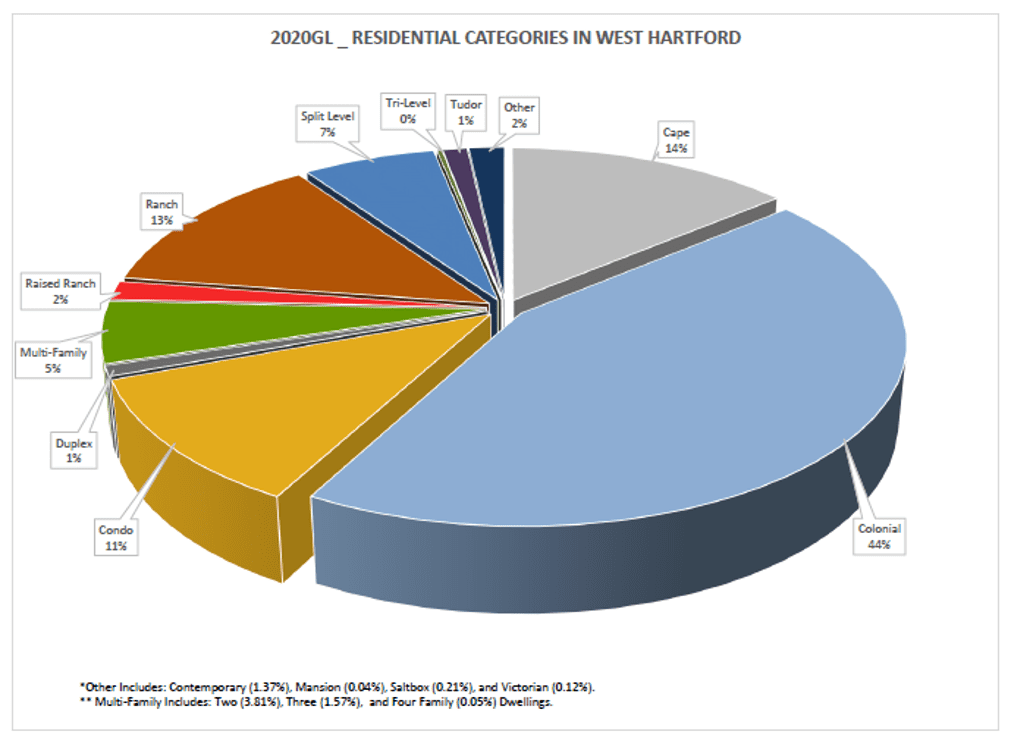

Oct. 1, 2020 West Hartford residential Grand List breakdown.

Like what you see here? Click here to subscribe to We-Ha’s newsletter so you’ll always be in the know about what’s happening in West Hartford! Click the blue button below to become a supporter of We-Ha.com and our efforts to continue producing quality journalism.

Loading...

Loading...