West Hartford Grand List Has Largest Increase this Decade

Audio By Carbonatix

West Hartford Town Hall. Photo credit: Ronni Newton

West Hartford’s 2019 Grand List, which reflects the value of real property, business personal property, and motor vehicles as of Oct. 1, 2o19, increased 0.82% over the previous year.

By Ronni Newton

The 2018 Grand List submitted to Town Manager Matt Hart Thursday by Director of Assessments Joseph Dakers shows a significant increase in personal property and motor vehicles, and increases in real property as well.

According to Dakers, the overall Grand List increase is 0.82%, which is the highest increase in the past decade in a non-revaluation year.

“This is very good news,” Hart told We-Ha.com. “It’s an indicator of how our community remains a very attractive place for investment on the commercial as well as retail side.”

Last year the Grand List increased 0.43%, and the previous year the increase was 0.778%.

The total value of West Hartford’s 2018 Grand List, which reflects all changes in ownership and valuation as of Oct. 1, 2019 – but does not reflect any revisions which may be made by the Board of Assessment Appeals – is $6,368,328,344. The overall increase is $52,036,239.

The overall increase was about twice as much as last year, Hart said.

“I’m pretty pleased about this,” Hart said. “Its a testament to West Hartford’s draw and attractiveness,” as the town continues to attract new and expanding businesses as well as continued residential investment.

Of that increase, a total of $31,168,568 was an increase in the Real Property list, representing growth of 0.55%.

According to Dakers’ memo to Hart, major factors in the growth include a change in the status of the UConn campus’ two parcels from exempt to taxable, adding $11,007,360; Delamar Hotel; Ringgold Estates (added incrementally as units are declared); and Gledhill Estates (added incrementally as units are declared). There were also 16 residential homes constructed during the period, and ongoing residential remodeling projects that contributed.

The seventh building at Steele Road LLC (243 Steele) added nearly $3.4 million in taxable value for the assessment period.

West Hartford’s highest taxpayer remains Blueback Square Holdings LP, valued at $72,983,440, followed by Westfarms (valued at $52,530,470) and Connecticut Light & Power (now Eversource) valued at $46,100,130.

Other top-10 taxpayers are the Corbin’s Corner property at 1459 New Britain Ave., valued at $42,378,420); SF West Hartford Property Owner LLC (The Corbin Collection) at 1445 New Britain Ave., valued at $29,271,060; Town Center West Associates (29 South Main St.) valued at $28,068,940; McCauley Center Inc., valued at $24,529,330; Steele Road LLC (243 Steele Rd.) valued at $23,426,410; BFN Westgate LLC (1248 Farmington Ave.) valued at $20,510,450; and Bishops Corner E&A LLC (2523 Albany Ave.) valued at $18,200,000.

The Motor Vehicle list increased in terms of value and vehicle count this year. The value increased by $15,001,212, representing 3.5%. The vehicle count increased by 189 to total of 46,748. The previous year the number of vehicles decreased by more than 750, but the value increased by about 0.5 percent.

The Personal Property list increased by $5,866,459 or 2.9% according to Dakers. A net increase of 17 new businesses, as well as completed business personal property audits and investments in capital equipment by existing business led to the change.

The Grand List is just one component of the town’s budget – the first step in the process of determining the mill rate for the upcoming fiscal year. The current mill rate is 41.8 mills for real and personal property as well as for motor vehicles.

The 0.82 percent increase in Grand List, based on the existing mill rate, would generate $2,175,115 in additional tax revenue, Hart said.

Next year’s Grand List should reflect some additional value at the Ideanomics (former UConn) site, as well as additions at Corbin’s Corner. There may be some additional value at One Park (corner of Park Road and Prospect Avenue), he said, and additional units at Ringgold Estates and Gledhill Estates should also be included.

The town’s next revaluation will take place during FY22, reflecting the value of the Grand List as of Oct. 1, 2021, Hart said.

West Hartford’s budget for 2020-2021 (FY21) is scheduled to be submitted to the Town Council on March 10, 2020, and adopted on April 20, 2020.

Like what you see here? Click here to subscribe to We-Ha’s newsletter so you’ll always be in the know about what’s happening in West Hartford!

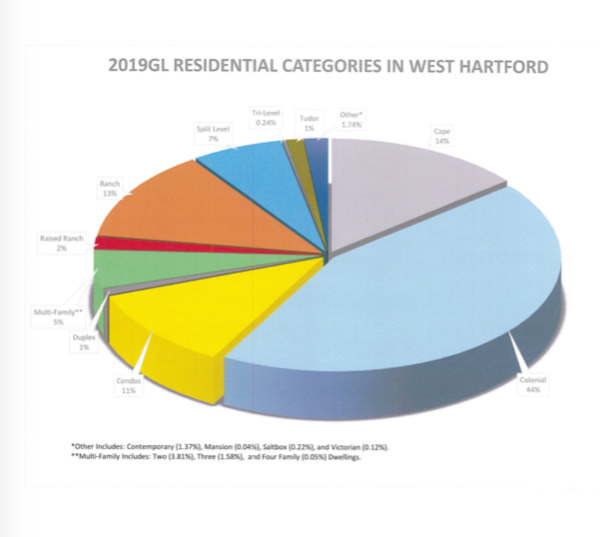

Courtesy of Town of West Hartford

[…] to increase by $11,925,721 to support the proposed spending plan for FY2021, offset in part by growth in the grand list of 0.82 percent – the largest increase in the past decade which will generate approximately $2,175,114 in […]