Consumer Diary: Damaged Luggage, Tax Scammers, New Tax Laws

Audio By Carbonatix

On arrival at Miami International Airport last week we found my wife’s damaged suitcase. But Delta’s damage policy doesn’t cover dents. Photo credit: Harlan Levy

Consumer columnist and West Hartford resident Harlan Levy has more than 20 years of experience writing stories about everyday experiences that anyone could encounter.

Harlan Levy. Courtesy photo

By Harlan Levy

On arriving at Miami International Airport last week on a Delta flight, we found my wife’s suitcase with a big dent and a small tear. We went to Delta’s luggage complaint desk and were told that Delta doesn’t cover dents – only wheels and pull-out handles. “Just push it out from the inside,” the clerk said. My wife did. We are not happy.

Now you know.

Tax scammers

Connecticut’s Department of Consumer Protection and Department of Revenue Services are warning the public about scammers pretending to be professional tax accountants and firms for the upcoming tax season.

“Taxpayers should start their research by reading reviews and checking the accountants’ credentials,” said DCP Commissioner Bryan Cafferelli. “A hasty decision in choosing a fake tax preparer can lead to stolen information, an incomplete tax return, and a bigger headache than if you’d simply done your taxes yourself.”

Key warning signs include tax preparers who charge a fee based on the size of the refund, as well as those who are unwilling to sign your return. When searching for a tax preparer and/or accounting firm, a taxpayer should:

- Use eLicense to check if the Certified Public Accountant (CPA) has an active license or that the CPA firm is registered.

- If the individual is a Paid Tax Preparer, taxpayers should contact Revenue Services to verify their license.

- Individuals with a CPA Certificate Registration cannot sign tax documents. Only those with a CPA license are able to sign tax documents. All firms, including home offices, must have a Certified Public Accountancy Firm Permit to practice in Connecticut.

- Be skeptical of tax preparers promising to get you a massive refund fast. Deals that seem too good to be true are red flags.

- Look up the name of the tax preparer or firm followed by the words “review” or “complaint.” Taxpayers can also contact the IRS for complaints. Check the National Association of State Boards of Accountancy’s website to verify enrolled CPAs.

- Ask a family member or friend for a tax preparer recommendation. Use a tax professional who is local and available all year, in case questions arise.

- Never sign a blank form. You should always thoroughly review the tax return before signing, as you are responsible for the information.

- Check for Prepare Tax Identification Number (PTIN) or BBB Seal. All tax professionals must have a PTIN and include it with their signature. Real tax professionals will provide this number without resistance. For tax firms, look for the Better Business Bureau (BBB) seal on the website.

Consumers who want to file a complaint related to a tax preparer can email DCP at [email protected] or visit ct.gov/DCP/complaint to file a complaint online.

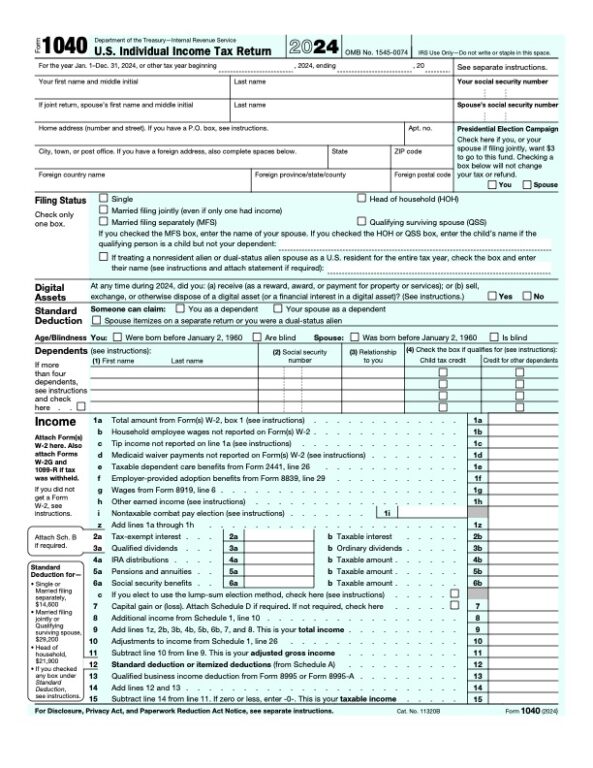

Form 1040. IRS.gov

Tax law changed for 2025

Does anyone besides your accountant want to think about filing your income taxes right now? Not me.

In any event, the good news is that the IRS has changed the tax laws for 2025 – to your advantage.

You could end up in a lower bracket for your earned income in 2025. Also, the standard deduction – the amount on your 1040 tax return without itemizing – will be higher.

The 2025 standard deduction – the fixed amount you can deduct from your annual income if you don’t itemize your deductions will be $15,000 for single filers and $30,000 for married couples filing jointly, up from $14,600 and $29,200, respectively, for 2024.

Also, single filers 65 and older can increase their standard deduction in 2025 by $1,600 per person; joint filers can increase their standard deduction by a combined $3,200. In total, a married couple 65 or older would have a standard deduction of $33,200.

NOTE: If you have a consumer problem, contact me at [email protected] (“Consumer” in subject line), and, with the power of the press, maybe I can help.

Like what you see here? Click here to subscribe to We-Ha’s newsletter so you’ll always be in the know about what’s happening in West Hartford! Click the blue button below to become a supporter of We-Ha.com and our efforts to continue producing quality journalism.