Consumer Diary: Stink Bugs and Other Pests, Scams Are Big Business

Audio By Carbonatix

Image courtesy of Harlan Levy

Consumer columnist and West Hartford resident Harlan Levy has more than 20 years of experience writing stories about everyday experiences that anyone could encounter.

By Harlan Levy

After last week’s heavy rains I brought inside the house plants that have flourished outside during the summer. I also asked scientist Dr. Gale Ridge from the Connecticut Agricultural Experiment Station for some advice, as follows:

Check the plants for “little visitors” that may have crossed over from other plants, particularly aphids and spider mites. “Pay particular attention to the undersides of leaves where most of these arthropods shelter,” she said. “Use insecticidal soap which suffocates and is acceptable as an organic treatment. Treat on a warm dry day before bringing any plant back inside the home. It’s easier to work outside.”

As the weather cools, our outdoor plants need to come inside, possibly with various bugs. Courtesy of Harlan Levy

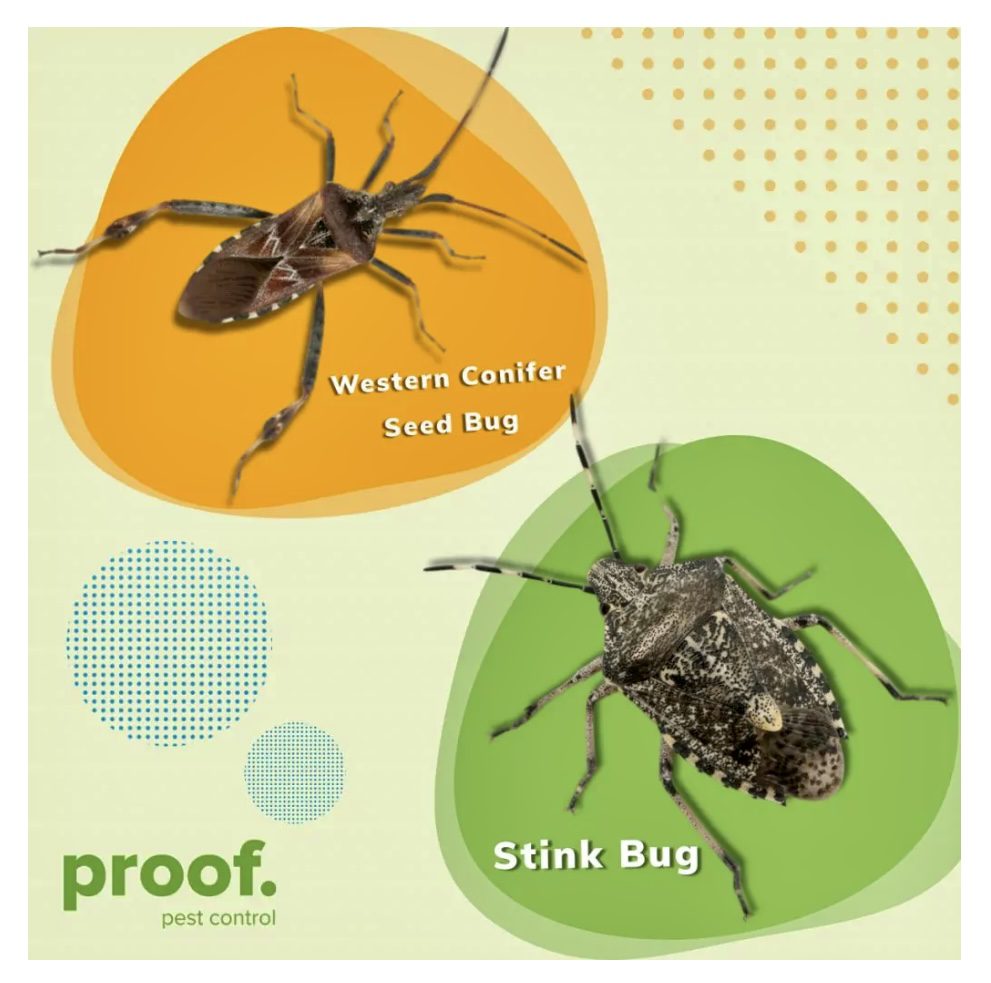

Watch for: the brown marmorated stink bug, a garden and orchard pest first noticed in 1998 and now spread across the eastern half of the states. Never squash them: Terrible odor! Eliminate them by:

- Seal small gaps, holes in home exterior.

- Hang a damp towel outside to attract them. Shake them into a bucket of liquid detergent and water. They’ll drown. Inside, flick them off screens, walls, drapes into the bucket.

- Clean spills. Put food away.

- Repair leaks, unclog drains.

- Inspect all packages, grocery bags.

- Flick bugs into sealable bottles.

- Vacuum them up on sight.

The Western Conifer Seed Bug, also stinky, introduced to Connecticut in the mid-1980s in souvenir pinecones. Eliminate them by:

- Seal or caulk gaps around door and window frames and soffits. Tighten loose-fitting screens, windows, doors.

- Spray insect repellent around the outside perimeter of your house.

- Vacuum them up on sight.

The multi-colored garden-friendly Asian Lady Beetle. Eliminate them inside by:

- Seal all cracks, gaps, and crevices.

- Spray a repellant.

- Set up a wooden Ladybug house with holes that contains a lure (such as raisins or sugar water).

None of the three is harmful or damaging.

Harlan Levy. Courtesy photo

Consumer scamming: Big business in Connecticut

The evidence: The number and type of consumer complaints lodged in the state through Aug. 29 by the U.S. Consumer Financial Protection Bureau. To date the CFPB has returned $17.5 billion to wronged individuals in all 50 states, including Connecticut, since it opened 12 years ago.

The data for Connecticut:

- 9.76 complaints per 1,000 people.

- 35,184 complaints that the CFPB took action on.

- 1,910 complaints from people 62 and older that the CFPB took action on.

Top complaint categories:

- Credit reporting, credit repair services, or other personal consumer reports: 13,809 complaints. Issues include: Incorrect credit reporting about inquiries or payments, information errors on credit reports, credit report privacy concerns, predatory fees by credit repair services, and more.

- Mortgage: 4,977 complaints. Products include home mortgages, Federal Housing Administration and U.S. Department of Veterans Affairs mortgages, home equity loans, and reverse mortgages. Issues include: Payment process problems with autopay, escrow, taxes, and insurance; struggling to pay mortgages and foreclosures; and unfair fees and applications.

- Debt collection: 3,911 complaints. Products include medical, auto, credit card, student loan, and mortgage debt. Issues include: Attempts to collect debt not owed, debt that was paid off, debt disputes due to identity fraud, and more.

- Credit card or prepaid card: 2,768 complaints. Credit cards, store cards, government benefit cards. Issues: Cards being opened or closed without permission, transaction errors, declined card usage, unfair fees, or application denials.

- Checking or savings account: 2,617 complaints. Checking accounts and other banking products and services, savings accounts, certificates of deposits. Issues include: Fees, privacy concerns, accounts opened without permission, fraudulent transactions, managing an account related to deposits, withdrawals, ATM cards, and more.

Top four issues on which Connecticut consumers sought help:

- Incorrect information on credit report: 6,287.

- Improper use of the consumer’s credit report: 3,938.

- Problem with a credit reporting company’s investigation into an existing problem: 3,492.

- Managing an account: 1,782.

NOTE 1: On Oct. 3 the U.S. Supreme Court heard oral arguments in CFPB v. Community Financial Services Assoc. challenging the constitutionality of the agency’s independent funding structure and seeking to limit the CFPB’s autonomy and capacity to levy fines and impose sanctions. The Supreme Court’s decision due next spring, could significantly harm consumers and disrupt financial markets.

NOTE 2: From Oct. 15 to Dec. 7 is when everyone with Medicare can change health plans and prescription drug coverage for next year. Go online to cms.gov for details and choices.

West Hartford resident Harlan Levy has been a consumer columnist for more than 20 years. He concentrates on revealing notable personal experiences and everyday consumer situations that either he or his wife encounter — sometimes ridiculous, outrageous, or downright laughable. But all relate to most readers’ common predicaments, including damaged goods and unresponsive sellers, unwanted automatic renewals, and various deceptive, insidious scams. He offers analysis, warnings, and practical solutions and advice.

Like what you see here? Click here to subscribe to We-Ha’s newsletter so you’ll always be in the know about what’s happening in West Hartford! Click the blue button below to become a supporter of We-Ha.com and our efforts to continue producing quality journalism.