From the West Hartford Archives: West Hartford Bank & Trust Company

Audio By Carbonatix

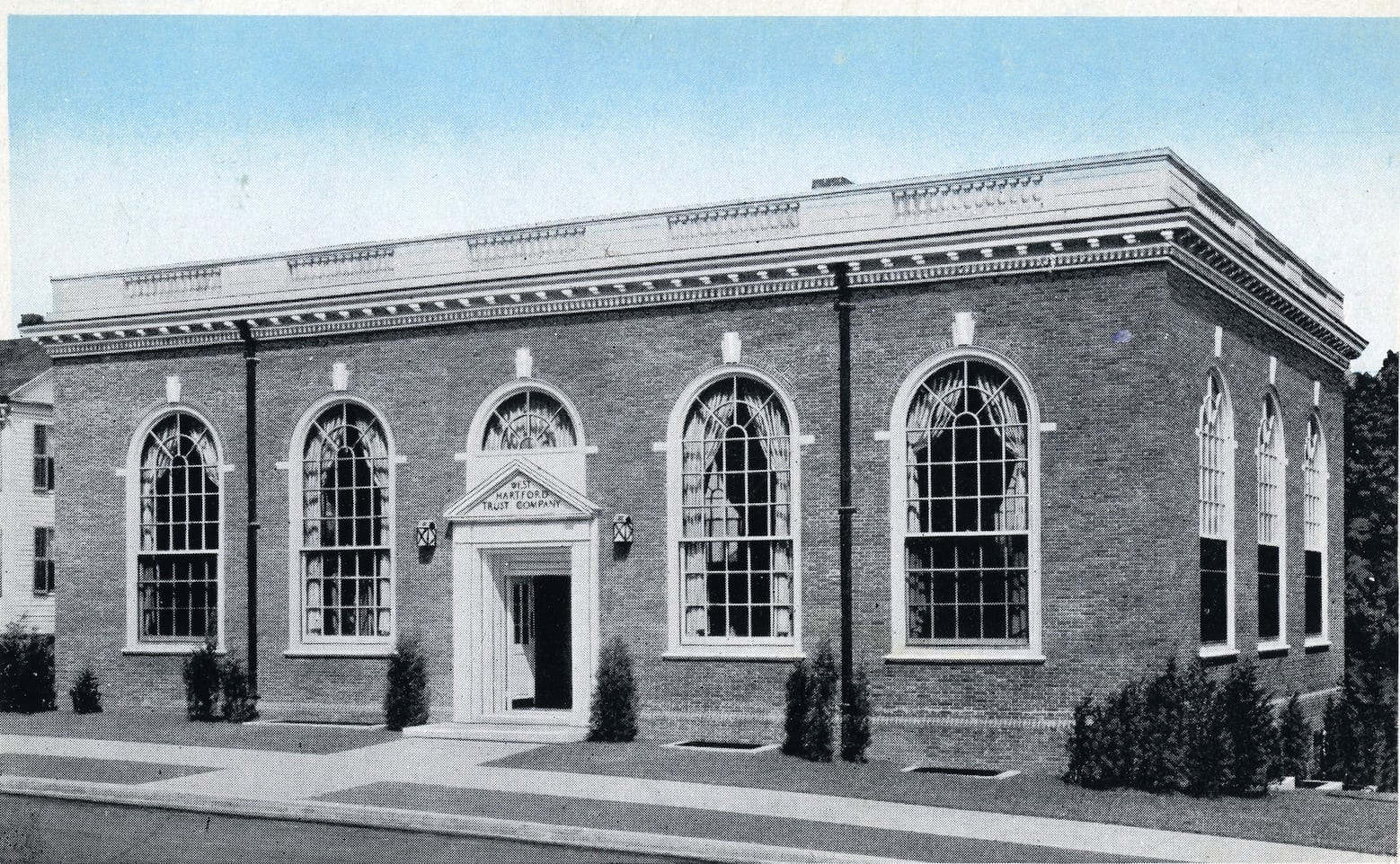

West Hartford Trust Company at the northeast corner of Farmington Avenue and North Main Street. Photo courtesy of Noah Webster House & West Hartford Historical Society

Historian Jeff Murray takes a look into West Hartford’s past to uncover some surprising information, stir up some memories, or reflect on how much life has changed – or hasn’t changed at all. Enjoy this week’s ‘From West Hartford’s Archives’ …

By Jeff Murray

In the fall of 1925, two bank charters for West Hartford were applied for, including one for the West Hartford Bank & Trust Company. Until then, West Hartford did not have its own bank, forcing the locals to conduct their banking in Hartford and beyond. The town had been growing quickly, especially in housing, so there was a demand for a local bank.

When events like this happen in our town’s history, I make it a point to look at the national context at the time. After all, these things don’t happen by themselves.

What made 1925 such a good time for the incorporators to band together to apply? West Hartford of course was not the only town growing in the 1920s. The Roaring Twenties were a period of massive economic growth and prosperity, backed by a rise in consumer spending and technological innovations. A general optimism in a great economy, including lax regulation, meant that banks would have been in demand as new homes were built and homeowners sought out credit for their investments.

The widespread use of automobiles and new road construction, as well as a steady migration into a suburban town like West Hartford, meant that more land was being developed into housing. The creation of a local bank would have helped to centralize operations for this future growth; in retrospect, this is quite ominous considering just a few years later, small banks were some of the first casualties of the Great Depression.

The state banking commission granted the charter of the West Hartford Bank & Trust Company two months after the application in December 1925. There was a general agreement that although two banks had originally been proposed (by different incorporators), there was only a need for one.

With an initial capital of $100,000 and an additional $125,000 in surplus for safety, stock was distributed to West Hartford residents only and sold in small quantities, encouraging community-led, individual ownership of shares. It organized into four departments: savings accounts, commercial banking, safe deposit work, and Christmas funds, which were savings programs that encouraged people to save money throughout the year for holiday costs.

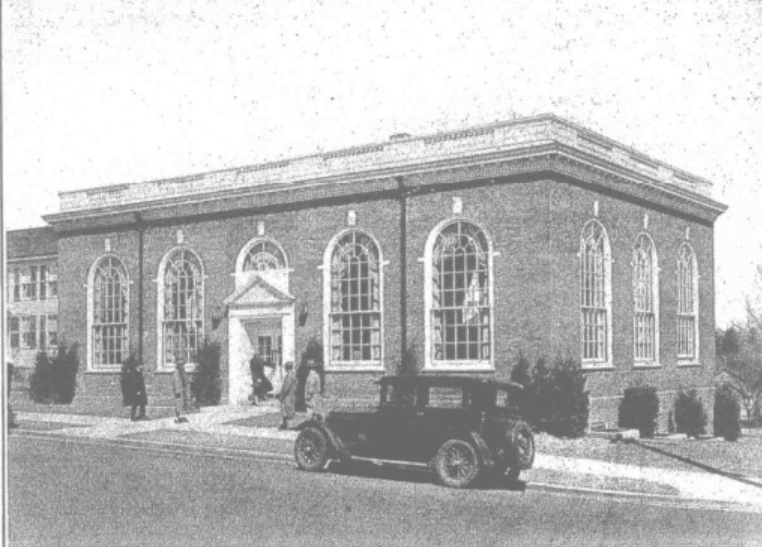

A view of the bank building in 1926-1927 as seen in William Hall’s book on West Hartford

In looking for an ideal location for the bank, a site in the Center was preferred by the incorporators. Soon after the charter was granted, President Roy T. H. Barnes bought the northeast corner of Farmington Avenue and North Main Street from Susie B. Andrews, including the Andrews homestead, which was moved just north and can actually be seen to the left in the featured photo.

Last week’s article noted Susie Andrews’ contributions to the section of Farmington Avenue to LaSalle Road, including her sale of land to developers in the 1920s. The northeast corner of Main Street was no different – she had inherited the land from her father decades before and the sale to the bank in 1925 helped pave the way for the modern Center.

Her husband, Myron Andrews, was also a banker in Hartford. The following year was spent establishing building lines, excavating, and grading, and then constructing the new building at the corner. The interior vault could hold up to 1,000 safe deposit boxes and the door itself weighed 20,000 pounds. The bank was completed and opened on Dec. 13, 1926, and on its first day, 225 accounts were opened with total deposits of $200,000.

The catastrophic stock market collapse in the fall of 1929 marked the beginning of the Great Depression, but it did not signal immediate disaster for the town. The West Hartford Trust Company continued undeterred.

A month after the crash, advertisements for the bank in the Hartford Courant acknowledged the mood: “Stock market fluctuations never shrink your funds left in this bank.” In any other context, this would be general marketing, but in November 1929, it may have been meant to calm the nerves from the constant front-page news about the stock market wobbles on Wall Street.

Increases in dividends for some local banks by Christmas kept afloat the idea that everything was fine. Under the surface, however, confidence in the system was slowly eroding and withdrawals increased. Banks across the country began to fail throughout the fall of 1930, including the fourth largest in the country that December. To Americans today, this is part of the Great Depression narrative, but its closure was actually a surprise to most of Wall Street.

In the short-term, it seemed quite easy to think that it was all temporary. That attitude would not hold though as 1931 saw a worsening banking crisis and mass unemployment.

The West Hartford Trust Company, however, reported a net gain of more than 500 accounts by the start of 1932. West Hartford’s building boom of the 1920s had continued and the company had been strengthened from the decisions of its first few years, allowing it to not only weather the storm, but to thrive in it.

At the onset of FDR’s inauguration in 1933, early talk of New Deal banking reforms came under fire from the president of the bank here, who feared that sweeping government changes would undermine states’ rights and hurt the economy of smaller towns that had been relatively insulated – this kind of attitude would have been influenced by the bank’s success in these years. In other words, “We got it right and now the President of the United States and Congress want to change how we do things.”

Of course, at a national level, significant banking reforms in the summer of 1933 helped restore confidence in the banking system, but the scope of government intervention remained a sore spot for West Hartford Trust. The bank eventually merged to become the town branch of Connecticut Bank & Trust (then called Hartford-Connecticut Trust Company), which added a drive-in, an addition to the main building, and a large parking lot on Farmington Avenue in the 1950s.

Today, the corner is the site of Bank of America in the same building, just shy of 100 years since its construction.

William Hall had written about the bank, that they had been chartered “with clearness of vision with respect to its future.” Written before the Great Depression, this may seem like an ominous warning. But it seems he was right.

The building that was West Hartford Bank & Trust, now Bank of America, looks very similar today. Google Street view

Jeff Murray was born and raised in West Hartford and has been involved with the Noah Webster House & West Hartford Historical Society since 2011 when he was a high school student and won the Meyer Prize for his essay on local history. Jeff routinely volunteers as local history researcher uncovering information for numerous museum programs such as the West Hartford House Tour and West Hartford Hauntings. Jeff works as a data analyst at Pratt & Whitney.

Like what you see here? Click here to subscribe to We-Ha’s newsletter so you’ll always be in the know about what’s happening in West Hartford! Click the blue button below to become a supporter of We-Ha.com and our efforts to continue producing quality journalism.

What about the building just to the left? Used to be a hairdresser upstairs, Mr. Henri. Also on street level a soda shop with nice sandwiches and hot fudge sundaes with peppermintstick ice cream . 1950s, I think.