West Hartford FY25 Budget Proposal Increases Taxes 5.13%

Audio By Carbonatix

West Hartford Town Hall. Photo credit: Ronni Newton

West Hartford Town Manager Rick Ledwith proposed a $349 million budget Tuesday night that increases spending by 5.4% and would result in a 5.13% tax increase, and the Town Council will meet over the next several weeks, and hold two public hearings, before deciding on the final spending plan.

By Ronni Newton

There are several major challenges impacting the budget for Fiscal Year 2025 that Town Manager Rick Ledwith presented to the Town Council on Tuesday night, and as he outlined the key elements of the spending plan he also highlighted the town’s accomplishments and preparation for the future.

Ledwith provided specific details about those challenges during his presentation, and noted that on the expense side, the outlier is a contingency fund for unsettled labor agreements, and on the revenue side minimal grand list growth in this cycle has an impact.

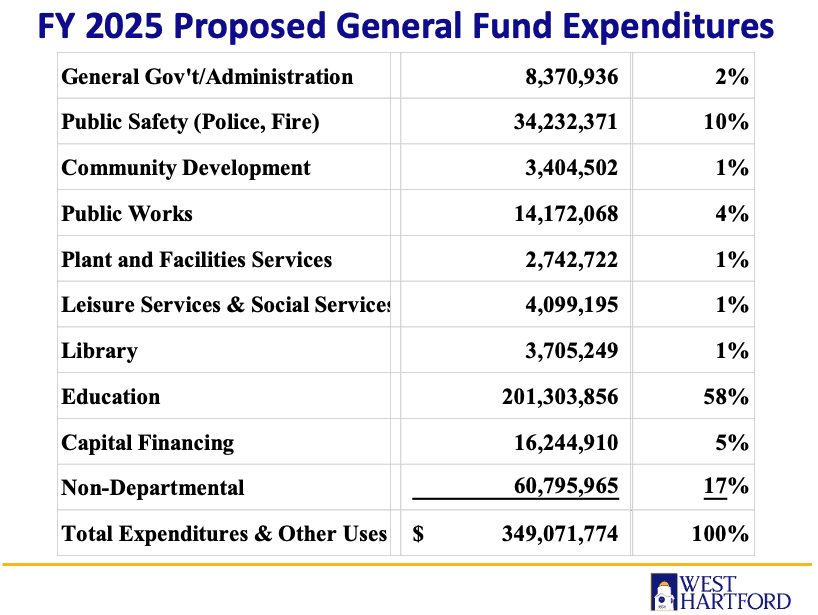

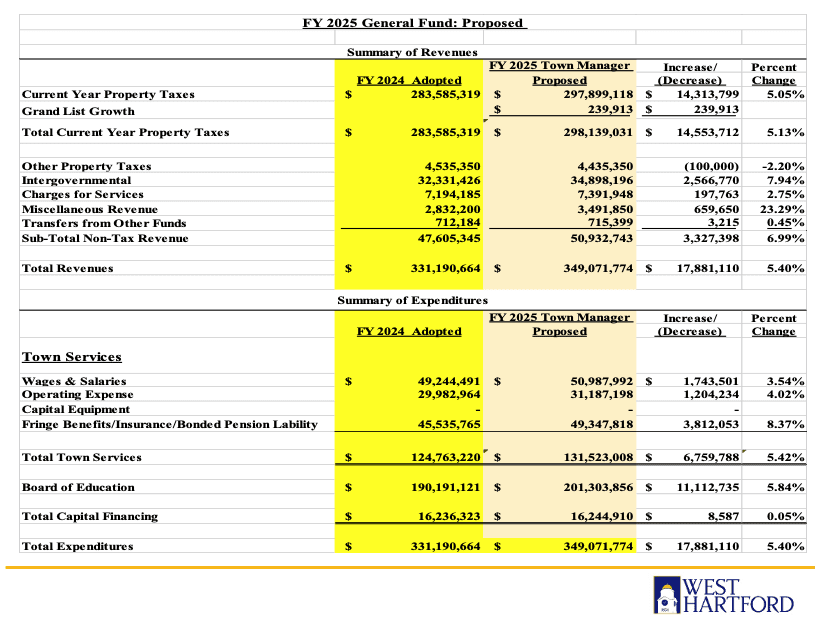

The proposed $349,071,774 FY25 budget increases overall spending by 5.4% ($17,881,110) over the town’s FY24 budget.

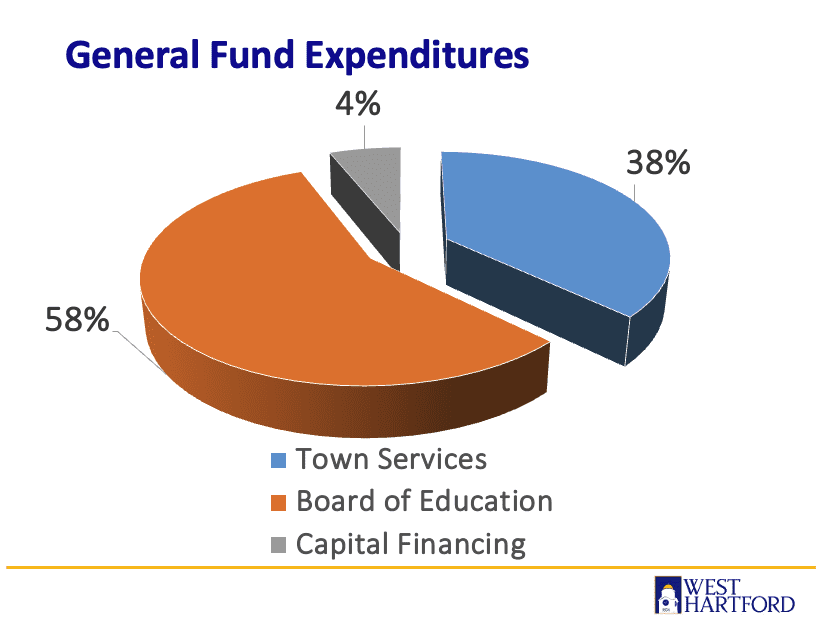

Town services are projected to increase by $6,759,788 (5.42%), and Board of Education expenses, based on the proposal delivered by Superintendent of Schools Paul Vicinus on March 5, are estimated to increase $11,112,735 (5.84%). Capital financing costs are estimated to increase very slightly in FY25 by $8,587 (0.05%). The percentage of each category relative to the overall budget is virtually unchanged from FY24.

Proposed General Fund expenditure for FY25

Under the proposed FY25 budget, the mill rate of 40.92 mills would increase to 42.9 mills (4.84%) while the motor vehicle mill rate, subject to a cap by state statute, will remain unchanged at 32.46 mills.

Ledwith said the FY25 budget is “a budget that we feel strongly fosters a thriving West Hartford while building a safer, stronger, more sustainable community for the future. … The values and strategies in this proposed budget align with those that have been in place for several years and includes policies and actions that underscore strategic investments in current and future needs and support for innovative ways to deliver key services to maintain the health, safety and quality of life for our growing community.”

Those overriding values and strategies, Ledwith said, will allow the budget to continue to fund initiatives that build on the town’s success and address emerging issues, promote equity through “programs to maximize West Hartford’s affordability and accessibility,” and will allow the town to meet short-term goals of maintaining and strengthening infrastructure.

The budget is a “tool for the future,” supporting municipal programs and services that are essential to the quality of life in town – such as education, public health, public safety, public works and facilities, and the library, leisure, and social services, Ledwith said. In addition, the capital. improvement program (CIP), the majority of which is bonded, will allow for strategic investment in school security and air quality, roads, bridges, stormwater management, and parks and other recreational facilities.

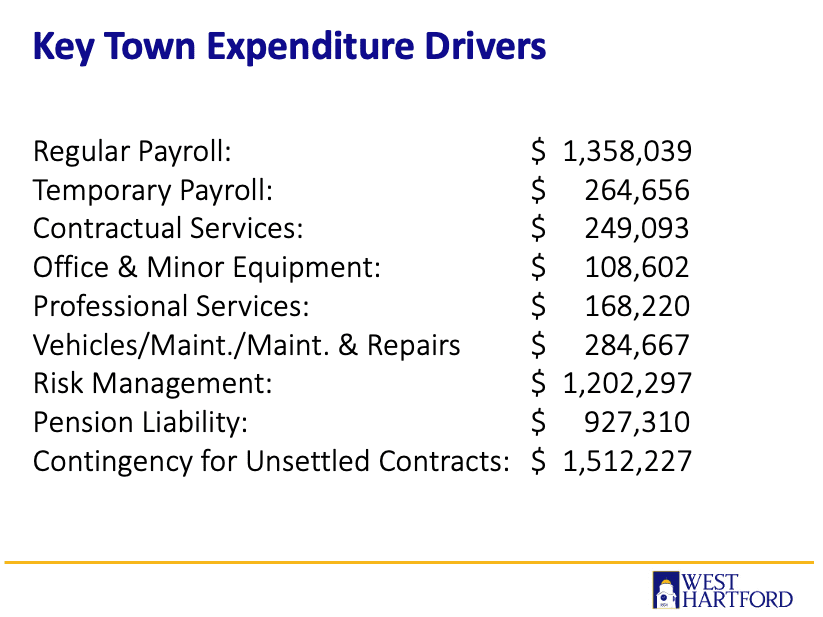

Expenses and drivers

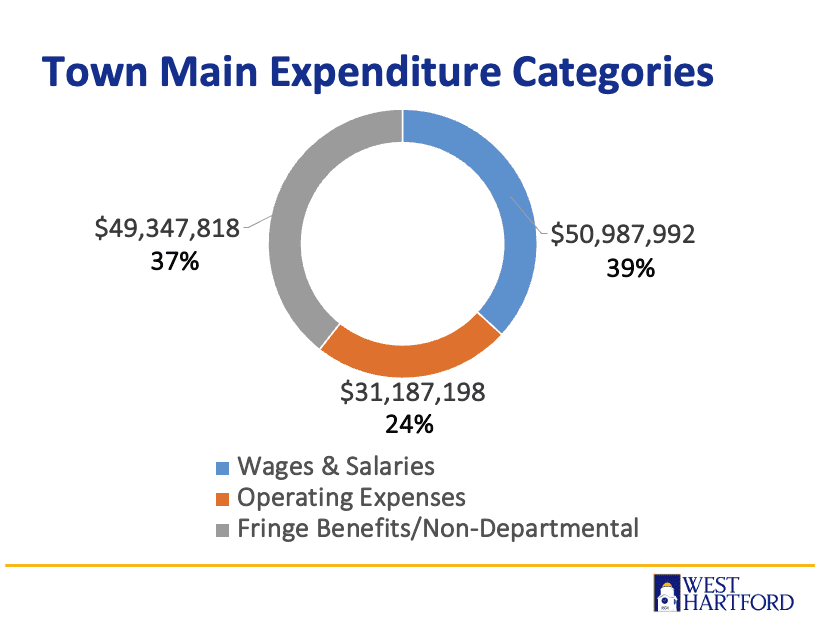

Wages and salaries are the largest piece of the town’s budget, and are estimated to increase by 3.54%, or $1.7 million. The costs are associated with full-time employees who have negotiated agreements, and due to the increase in the minimum wage, expenses for part-time seasonal employees will also increase.

Operating expenses on the town side are expected to increase by 4.02% or $1.2 million. “In this category we have a $172,000 increase to replace outdated non-lethal weapons or tasers,” Ledwith said. Also included is a $249,000 increase related to trash and recycling, $206,000 related to the town-wide radio system and license plate recognition camera system. “If were not to have had these three larger increases our operating budget would be up a little less than 2%, which is okay considering the Consumer Price Index sits around 2.5%,” said Ledwith, giving kudos to the directors for managing costs.

Dollar-wise and percentage-wise, the largest increase in expenses for the FY25 budget is an estimated 8.37% ($3.8 million) increase in the line item for fringe benefits, insurance, and bonded pension liability.

“The largest portion of this increase is attributed to a $1.5 million contingency account for unsettled labor contracts,” Ledwith said. In addition, there is an estimate of a $1.2 million increase in health care costs through the Connecticut State Partnership Plan. While that increase represents the initial estimate of 4%, the town has just learned that the plan will be renewed with a 2% increase, and that number will be modified prior to budget adoption. The budget for health insurance costs as part of the education budget will also be modified based on the recent news about the renewal cost.

“Our pension costs are up around $900,000 and we continue to set aside funds for our post employment obligations with an additional $400,000 for our retiree health care reserve fund,” said Ledwith, which highlights the Council’s commitment to prudent financial management.

“We are a people driven business providing direct services,” said Ledwith.

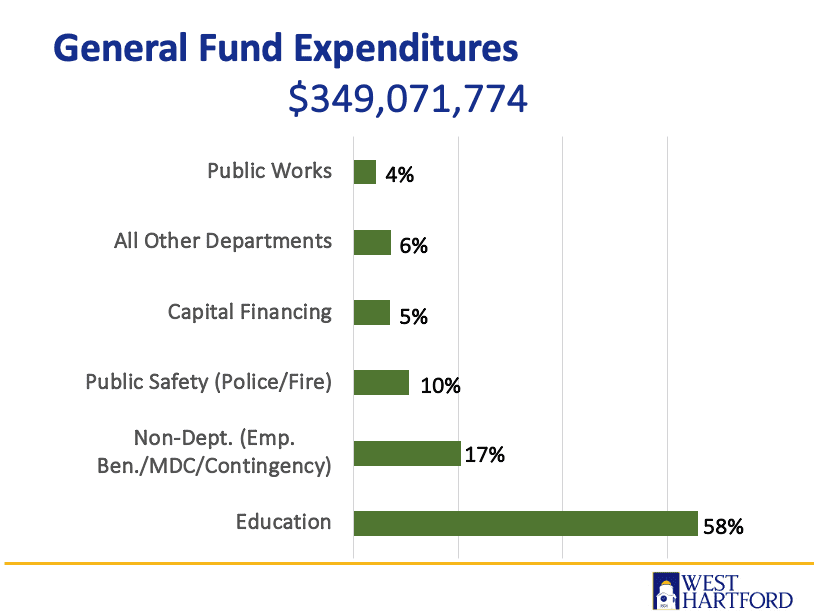

Looking at expenses in terms of categories, education – where there are roughly 1,600 employees serving roughly 9,000 students – is the biggest piece of the pie at 58%. On the town side, public safety (police and fire) as well as public works account for significant percentage of expenditures.

Payments to the MDC, often a driver of budget increases, remain flat this year, and on an overall basis, pension liability costs are estimated to decrease by $352,026.

Impacting the education budget, there has been a more-than-modest increase in the special education population, and the increase in tuition alone for those who require placement outside the district is about $1.5 million, Ledwith said. While the Town Council cannot make line-item changes to the education budget, Ledwith said he “will work closely with our superintendent and his team to strike a balance that maintains our investment in our future and allows our schools to continue to prepare and inspire all of our students.”

The largest outlier driving the increase in town expenses for FY25 is the $1.5 million contingency for unsettled contracts. Negotiations for three unions, going back to 2021, are in the process of being concluded, and the AFSCME and Police Union contracts both expire on June 30 of the current fiscal year.

Revenue

Property taxes are the primary source of revenue for cities and towns throughout Connecticut, and West Hartford is no different. An estimated 85.4% of the revenue for FY25 will come from local property taxes, “which is certainly a challenge for us but one that we have been accustomed to managing,” Ledwith said. The percentage of revenue derived from property taxes has not changed much over the years.

When there is substantial grand list growth – which is typically the case – it greatly softens the impact, but this year the grand list in West Hartford grew just 0.08%.

“All the projects I just mentioned and significant growth occurring in every corner of town, they’re just not hitting at the right time,” Ledwith said. Over the next one to three years, as those projects are completed, the grand list should show significant growth.

Greatly impacting the overall grand list this year is also the fact that the value of motor vehicles in town dropped by a staggering $26.8 million, or 4.35%.

“We had significant increases in the our motor vehicle grand list coming out of COVID when the values in the used car market increased substantially due to supply and demand issues,” said Ledwith. One of the biggest hits in value is in the electric vehicle market, where, for example, there has been a 40% decrease in the value of the roughly 300 Teslas in town.

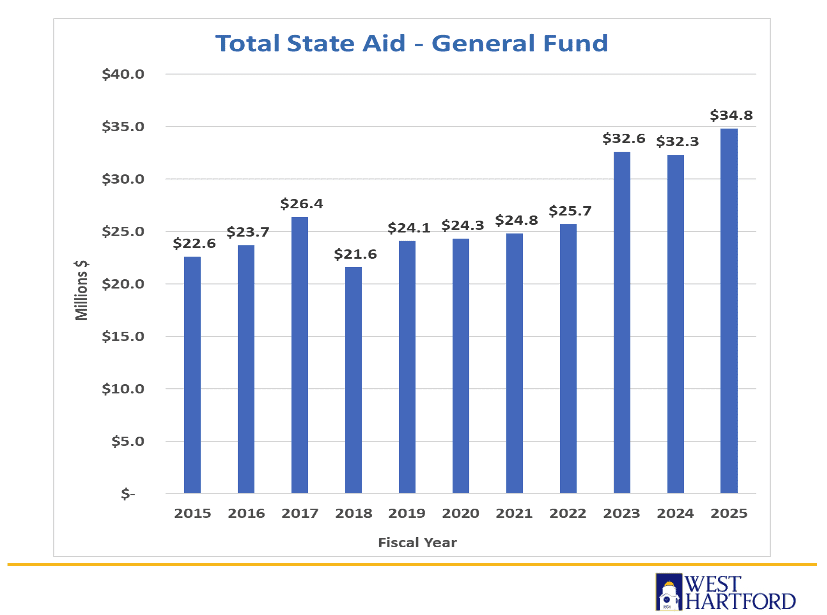

Positive news on the revenue side is a 7.9% increase in state aid of $2.6 million, mostly due to an increase in the Education Cost Sharing (ECS) grant of more than $2 million. There is also a nearly $200,000 increase in the PILOT (property payment in lieu of taxes) grant from the state.

State aid since 2015

CIP

The town’s 12-year Capital Improvement Plan, which totals nearly $522 million, is a commitment to maintaining and expanding infrastructure – town and school facilities, transportation and infrastructure, and flood mitigation – and is primarily funded through the issuance of General Obligation Bonds and federal and state grants. As part of the adoption of the FY25 budget, the Council will vote to approve years 1 and 2 of the CIP, proposed at $54 million and $40.8 million respectively.

Some of the major projects listed in the CIP will be paid for through ARPA funds – including reconstruction of LaSalle Road and Farmington Avenue in the Center – but other major items included in the CIP for the next two years are a $1 million investment in Vision Zero road safety improvements (expected to result in immediate impact), an initial $5 million for new Elmwood Community Center (which also includes a senior center, teen center and library), and school security upgrades at Wolcott Elementary School, which Ledwith said is the last school that requiring a security upgrade.

Also included in years 1 and 2 is $11.1 million for the “long-awaited elementary school air quality program,” and Ledwith said the town has applied for grants from the state to offset those costs.

Significant investments are also planned for a materials solutions center at the Public Works campus ($1.75 million) and $1.2 million in improvements to the police facilities.

The CIP is 84% funded through bonds, and Ledwith said the town will continue to apply for grants as further offsets to costs.

Accomplishments

Before outlining the budget itself, Ledwith also provided a brief overview of recent accomplishments, noting that “it is through the vision of this Town Council that moves us forward everyday to not just maintain being the premier community in Connecticut and beyond but always building on it as well. Those accomplishments include

- Vision Zero – West Hartford is the first town in the state to implement an action plan, and has committed $1 million to the initiative.

- Affordable options for residents, including the approval of plans that will lead to the addition of 150 new affordable housing units throughout town, at 900 Farmington, 1244 North Main Street, and additions to West Hartford Fellowship Housing on Starkel Road. “This council even went a step further in creating an Affordable Housing Development Program utilizing $6 million of ARPA funds, which may be the highest commitment of ARPA funds towards affordable housing state-wide,” Ledwith said.

- Commitment of ARPA funds for small business grants and loans and. project such as wayfinding signage and the West Hartford Center Infrastructure Master Plan.

- Efforts to become more sustainable include the establishment of a Sustainable West Hartford Commission, successful food scrap recycling and pay as you throw pilot in the Morley neighborhood with plans to expand town-wide. West Hartford is one of 24 communities Silver-certified by Sustainable CT and one of nine designated as a “Climate Leader,” and will be applying for Gold certification this summer. The town will also be rolling out an electric vehicle strategy.

- “We also know that our children are receiving the best education possible delivered by exceptional teachers and leaders as Conard and Hall are in the top 15 high schools in the state and top 3% nationally,” Ledwith said.

- The town continues to receive national recognition, most recently from Livability and Niche, and this month’s article in Yankee Magazine is an “outstanding piece” that Ledwith said everyone should read.

- There is recent unprecedented level of investment in the community, Ledwith said, noting projects that are complete or in progress like One Park and the Byline, projects approved such as Center Park Place and Elmwood LOFTS, and projects that have been proposed like the Jayden and Heritage Park.

What’s next

The Town Council’s committees, as well as the Board of Education, will be working hard and reviewing the budget in detail over the upcoming weeks during virtual meetings and workshops that can be viewed by the public through West Hartford Community Interactive.

The public will have the opportunity to comment on the town’s General Fund budget at public hearings scheduled for Tuesday, March 26, at 6 p.m. at Town Hall, and Wednesday, April 3, at 2 p.m. at Town Hall.

Upcoming public meetings related to the Board of Education budget include:

- Budget Workshop No. 1, Wednesday, March 13, 7 p.m.

- Board Public Hearing, Wednesday, March 27, 7 p.m.

- Budget Workshop No. 2, Wednesday, March 27, following Public Hearing

- Board Budget Adoption, Thursday, April 4, 7 p.m.

The Town Council is scheduled to adopt the budget on Wednesday, April 24, 2024. That meeting will begin at 7:30 p.m.

All budget documents, including the Budget in Brief, are posted on the town’s website for review.

Like what you see here? Click here to subscribe to We-Ha’s newsletter so you’ll always be in the know about what’s happening in West Hartford! Click the blue button below to become a supporter of We-Ha.com and our efforts to continue producing quality journalism.

Raise your hand if you got a 5.13% or more raise at work this past year.

How about we cut spending instead?

Yet the roads remain a mess.

And our basements and yards continue to flood every time there is a heavy rain. But you have that plan no? At least there is that crumby bike path.