West Hartford Grand List Exceeds $7 Billion After Double-Digit Increase

Audio By Carbonatix

Front entrance of West Hartford Town Hall. Photo credit: Ronni Newton (we-ha.com file photo)

The Town of West Hartford has finalized its 2021 Grand List, which indicates an overall increase of more than 12% over the previous year for the value of real property, business personal property, and motor vehicles as of Oct. 1, 2021.

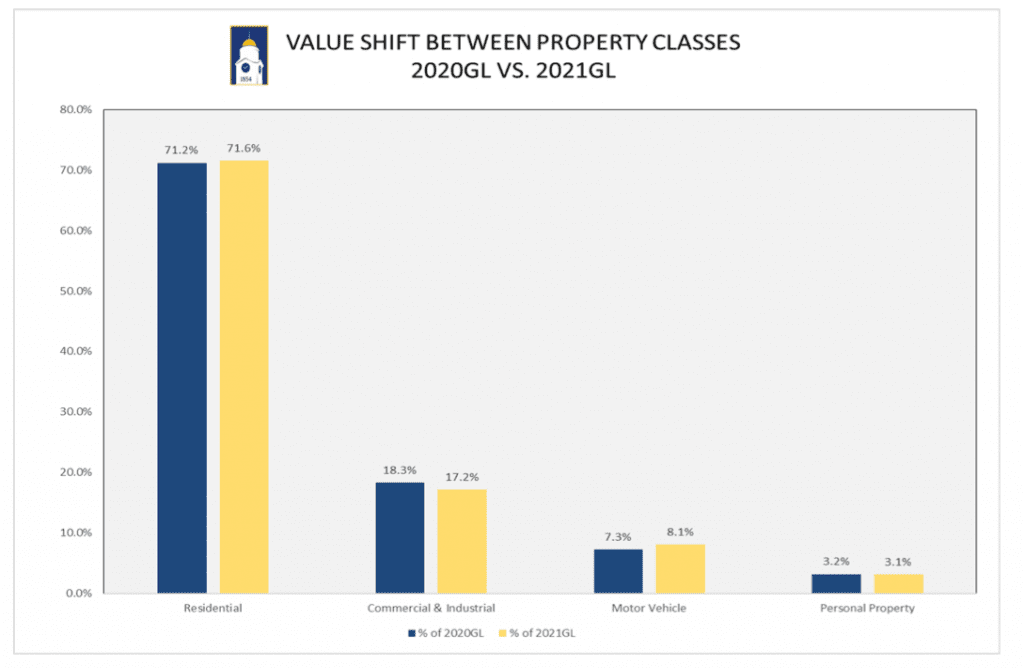

Value shift between property classes in West Hartford, 2020 vs. 2021

By Ronni Newton

The 2021 Grand List submitted to Town Manager Matt Hart this week by Director of Assessments Joseph Dakers indicates a significant increase in real property, personal property, and motor vehicle values, representing an overall increase of 12.2% in comparison to 2020 values.

The significant increase in taxable property, a level of growth much greater than in recent years, reflects the recent town-wide revaluation, a process which takes place every five years. The 2016 Grand List, when the last revaluation took place, showed growth of 4.33%.

The 2021 Town of West Hartford Grand List of taxable and exempt property effective Oct. 1, 2021 was finalized in accordance with Connecticut General Statutes and reflects all changes in ownership and valuation, and will become the basis for taxation for Fiscal Year 2023, which begins July 1, 2022.

“The total net assessed value of all taxable property, prior to Board of Assessment Appeal actions, is $7,177,283,988, representing an increase in the net taxable list of $781,171,777 over last year, a marked increase,” Mayor Shari Cantor said in a statement. “This is a testament to the strength of West Hartford’s local economy, and our community’s vibrancy.”

The submitted Grand List does not reflect any revisions which may be made by the Board of Assessment Appeals.

The Real Property list grew by 11.2%, with revaluation as well as residential construction projects as the key factors in the overall growth of $644,835,827. Dakers noted that projects at 71 Waterside Lane, 180 Wood Pond Road, 511 Mountain Road, 11 Griswold Drive, 111 Marion Avenue, and two new homes at Gledhill Estates were major contributors to the growth.

Commercial real estate projects are underway throughout town, but with most in the early stages of development they were not significant contributors this year.

An unprecedented growth in the Motor Vehicle List of 24.9%, or $115,934,401, is directly attributed to factors associated with the pandemic. Supply chain delays, and demand issues, have affected the new and used car market and leading to dramatic price and value increases.

Dakers noted that in September 2019, there were 3.5 million new cars in U.S. inventory, and a year later there were just 915,809 new vehicles available in the U.S., a drop of 74%.

In addition, Dakers noted that the 2020 net taxable supplemental list for motor vehicles totaled $78,840,697, an increase of 31.8% and reflecting 2,322 more vehicles, a 33% increase over the previous year. These figures are also related to the pandemic, with a 90-day closure of the Department of Motor Vehicles in 2020 leading to delayed vehicle registrations and renewals.

Personal Property list growth was also in the double digits, increasing by $20,401,924 or 10% to $224,438,924, despite a net loss of 29 businesses in comparison to the previous year. There are currently 2,690 businesses in town.

Dakers noted that “West Hartford continued to experience a healthy level of capital equipment re-investment in furniture, fixtures and equipment, surpassing annual depreciation on existing assets.”

One major increase in personal property values is $7 million contractor’s equipment and machinery associated with the Metropolitan District Commission’s underground tunnel project. In addition, the value of Eversource underground utilities has increased by $13.7 million and Comcast of CT Inc. property has increased by $2.3 million.

Overall, West Hartford’s highest taxpayer is Connecticut Light & Power, now known as Eversource, valued at $62,100,540. Other top taxpayers include the Corbin’s Corner property at 1459 New Britain Ave. valued at $47,159,700; Westfarms, at $44,371,380; Blue Back Square at $37,647,730; Town Center West Associates (29 South Main St.) at $29,502,330.

Rounding out the top-10 taxpayers are SF West Hartford Property Owner LLC (The Corbin Collection) at 1445 New Britain Ave., valued at $28,901,180; Steele Road LLC (243 Steele Rd.) valued at $26,140,700; ALNIC LLC (property occupied by Whole Foods at 50 Raymond Rd.), valued at $23,128,910; E & A Northeast Limited Partnership (Bishops Corner, 333 North Main St.) valued at $21,772,240; and ER West Hartford LLC (apartment complex at 1248 Farmington Ave.), valued at $21,123,990.

Preparation of the Grand List is one of the steps in the town’s budgeting process, and reflects the property values to which the mill rate applies. West Hartford’s budget for 2022-2023 (FY23) is scheduled to be submitted to the Town Council on March 8, 2022, and adopted in late April.

Hart, who will leave his role as West Hartford town manager at the end of this week to become executive director of the Capital Region Council of Governments (CRCOG), expressed his thanks to Dakers and others involved with the revaluation and assessment for completing the process on time and on budget amid a pandemic. “They really did a tremendous job under trying circumstances,” Hart said. “My thanks to all involved.”

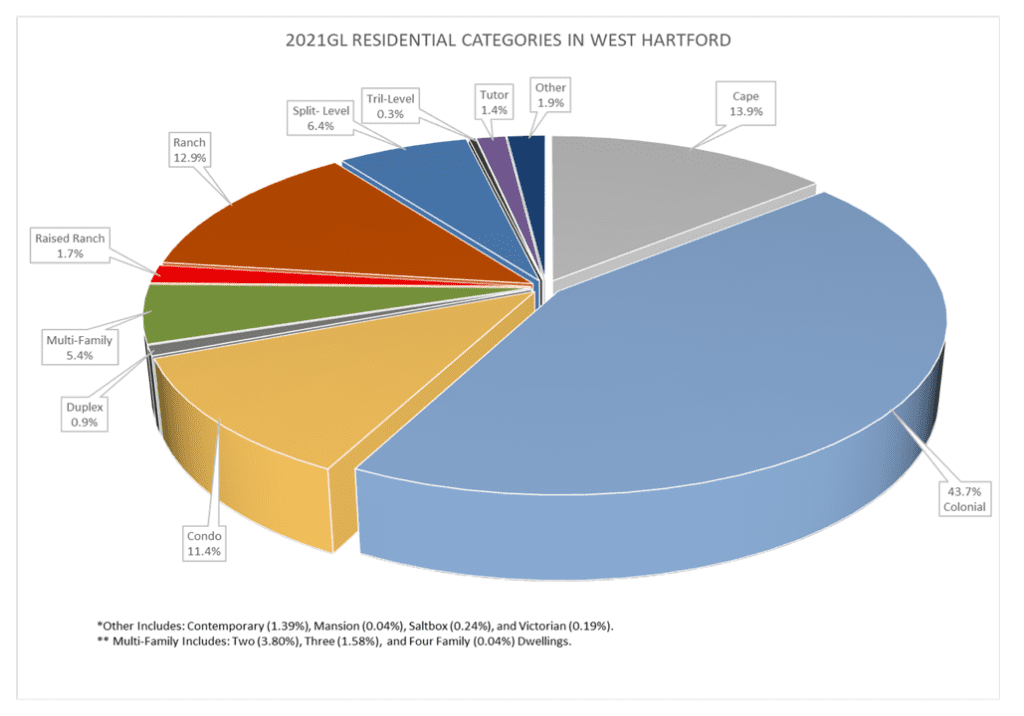

Oct. 1, 2021 West Hartford Grand List residential property categories

Like what you see here? Click here to subscribe to We-Ha’s newsletter so you’ll always be in the know about what’s happening in West Hartford! Click the blue button below to become a supporter of We-Ha.com and our efforts to continue producing quality journalism.

Loading...

Loading...

The grand list growth is not surprising. The fact that the WH Director of Assessments does not know the difference between tutors (those who help kids learn) and Tudors (the style of home) is ;^)

Mr. Dakers is fully knowledgeable in the area of assessments! I have met with him on

numerous occasions and found him to be pleasant and fully qualified for his job as WH Director of Assessment.