West Hartford Grand List Tops $7.2 Billion

Audio By Carbonatix

West Hartford Town Hall in winter. Photo credit: Ronni Newton (we-ha.com file photo)

The Town of West Hartford has finalized its 2022 Grand List, which indicates a slight overall increase of over the previous year for the value of real property, business personal property, and motor vehicles as of Oct. 1, 2022.

By Ronni Newton

The 2022 Grand List submitted to Town Manager Rick Ledwith this week by Director of Assessments Joseph Dakers indicates increases in real property and motor vehicle values, with a slight drop in the value of personal property, representing an overall increase of 0.6% in comparison to 2021 values.

While the percentage of growth between 2020 and 2021 was much dramatic and exceeded 12%, it represented the impact of revaluation which takes place every five years.

The 2022 Town of West Hartford Grand List of taxable and exempt property effective Oct. 1, 2022 was finalized in accordance with Connecticut General Statutes and reflects all changes in ownership and valuation, and will become the basis for taxation for Fiscal Year 2024, which begins July 1, 2023.

“The total net assessed value of all taxable property prior to Board of Assessment Appeal actions is 7,222,946,622 representing an increase in the net taxable list of 45,662,634 or 0.6% above last year’s list,” Dakers said in a memorandum that accompanied his transmittal of the document to the town manager.

“West Hartford’s local economy is strong,” Mayor Shari Cantor said in a statement, “We continue to see investments made by our residents to their homes and by businesses that are establishing here for the first time and those that are expanding due to growth and success. West Hartford is resilient and our town’s future is solid.”

The submitted Grand List does not reflect any revisions which may be made by the Board of Assessment Appeals.

The Real Property list grew by $11,518,537, or 0.2%. Dakers noted that “growth this year is largely the result of our ongoing renovation projects encompassing additions, updates to kitchens and baths, 32 new swimming pools, and other home improvements.” While there are multiple new developments underway, only a fraction of their value was reflected as of Oct. 1, 2022. Those projects include the 26 apartments at 10 Berkshire Road, the One Park Road development, the Byline at 920 Farmington Avenue, and single-family homes at 2 and 3 Gledhill Lane and 2664 Farmington Avenue.

Dakers also noted that the former Children’s Museum property at 950 Trout Brook Drive is now taxable. Redevelopment of that property is slated to begin in 2023.

On a percentage basis, the most significant growth was in West Hartford’s Motor Vehicle list, which increased by $34,765,182 or 6%. “This increase continues to reflect a very strong used car sales market,” Dakers said in his transmittal memo, noting, however, “there are signs this market segment is slowing down due to the ramping up of new car production after the slowdown during the COVID-19 pandemic, and supply chain issues.”

The supplemental Motor Vehicle List – which covers vehicles registered during the timeframe of Oct. 2, 2021 through July 31, 2022 – totaled $82,706,259. Dakers said that increase is $3,865,562 or 4.9%.

The Personal Property list experienced a slight decrease this year, dropping by $621,085 or 0.3%. A major factor in the decrease noted by Dakers was the removal of much of the $7 million in contractor’s equipment and machinery associated with the Metropolitan District Commission’s underground tunnel project, which was completed prior to Oct. 1, 2022. Once that project was completed, the machinery was removed from West Hartford and its value is no longer taxable.

The total census of businesses in West Hartford increased by a net of eight, to 2,698, Dakers said. “We continue to experience a healthy level of capital equipment re-investment in furniture, fixtures, and equipment, surpassing annual depreciation on existing assets.”

While the overall values changed slightly, the ranking of the town’s top taxpayers remained unchanged since the previous year.

Overall, West Hartford’s highest taxpayer is Connecticut Light & Power, now known as Eversource, valued at $61,814,320. Other top taxpayers include the Corbin’s Corner property at 1459 New Britain Ave. valued at $47,159,700; Westfarms, at $44,350,220; Blue Back Square at $37,771,010; Town Center West Associates (29 South Main St.) at $29,503,900.

Rounding out the top-10 taxpayers are SF West Hartford Property Owner LLC (The Corbin Collection) at 1445 New Britain Ave., valued at $28,901,180; Steele Road LLC (243 Steele Rd.) valued at $26,128,830; ALNIC LLC (property occupied by Whole Foods at 50 Raymond Rd.), valued at $23,128,910; E & A Northeast Limited Partnership (Bishops Corner, 333 North Main St.) valued at $21,772,240; and ER West Hartford LLC (apartment complex at 1248 Farmington Ave.), valued at $21,122,460.

Preparation of the Grand List is one of the steps in the town’s budgeting process, and reflects the property values to which the mill rate applies. The current mill rate, as adopted by the Town Council in April 2022, is 40.68 mills.

West Hartford’s budget for 2023-2024 (FY24) is scheduled to be submitted to the Town Council on March 8, 2023, and adopted in late April.

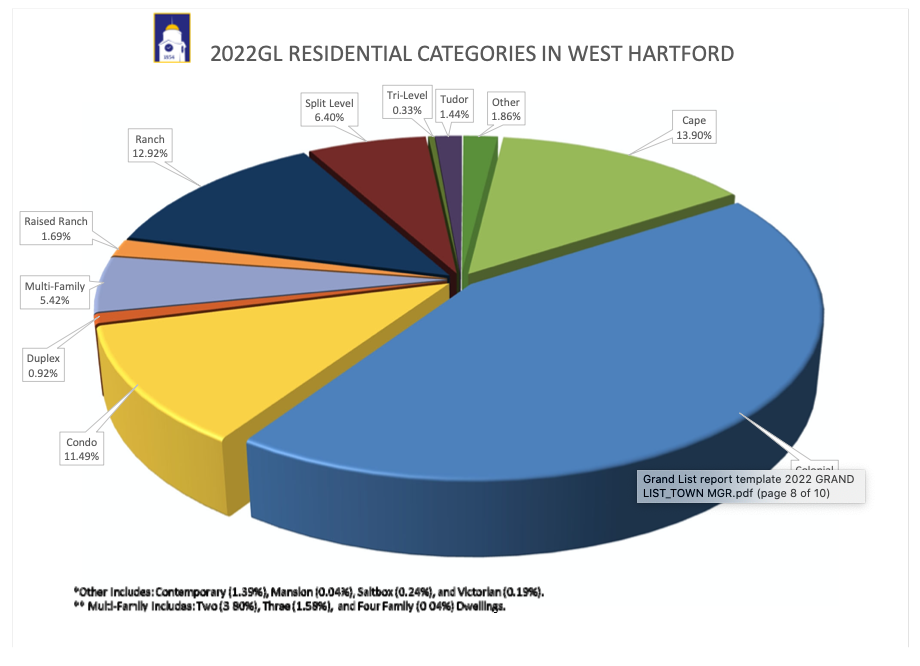

Oct. 1, 2022 West Hartford Grand List residential property categories

The complete Grand List report has been provided as a PDF below.

Like what you see here? Click here to subscribe to We-Ha’s newsletter so you’ll always be in the know about what’s happening in West Hartford! Click the blue button below to become a supporter of We-Ha.com and our efforts to continue producing quality journalism.

Loading...

Loading...

Yet we can’t even pave our roads. Where is an all going?

[…] The 2023 Grand List has been finalized and submitted to Town Manager Rick Ledwith by Director of Assessments Joseph Dakers, and indicates an overall slight increase of $5,642,357, or 0.08%, with increases in real property and personal property but offset by a drop in motor vehicle values in comparison to 2022 values. […]