West Hartford Town Council Grants Tax Abatement for One Park Road Project

Audio By Carbonatix

Rendering of One Park Road, Lexington Partners LLC project proposed for the Sisters of Saint Joseph Property. Town of West Hartford website

During a special meeting held Wednesday night, the West Hartford Town Council granted its first ever ‘tax stabilization agreement’ to LEX-LAZ West Hartford LLC, for the development of One Park Road at the corner of Park Road and Prospect Avenue, where the current Sisters of Saint Joseph property is located.

Rendering of entrance to One Park Road. Town of West Hartford document

By Ronni Newton

The West Hartford Town Council made a historic move Wednesday night – in part for the sake of history – by granting a tax stabilization agreement to the developer of One Park Road, paving the way for the $66 million project to move forward in a manner that preserves the chapel and the grounds of the Olmstead-designed property, secures housing for members of the Sisters of St. Joseph for as long as they wish, and ensures that a minimum of 10% of the apartment units will be set aside for affordable housing for at least 20 years.

The 10-year tax stabilization agreement, which takes effect as soon as LEX-LAZ West Hartford LLC assumes ownership of the property, was approved 6-2. Republican Counselors Chris Williams and Mary Fay voted against the agreement, and Democrat Beth Kerrigan, who said she worried that the Council was acting too quickly and setting a dangerous precedent, ultimately abstained from the vote.

Mayor Shari Cantor said that is a “one-of-a-kind situation,” and she expressed her disappointment that the National Park Service had decided that the proposal did not qualify for historic tax credits, which would have avoided the developer’s request for the stabilization plan.

“Now it’s up to us,” Cantor told her fellow Council members before the vote.

It has been eight years of no progress on a piece of property that has not provided tax revenue to the town for nearly 140 years, Cantor said. And while there may be other opportunities for development, they would likely be plain vanilla and not allow public access to the bucolic grounds.

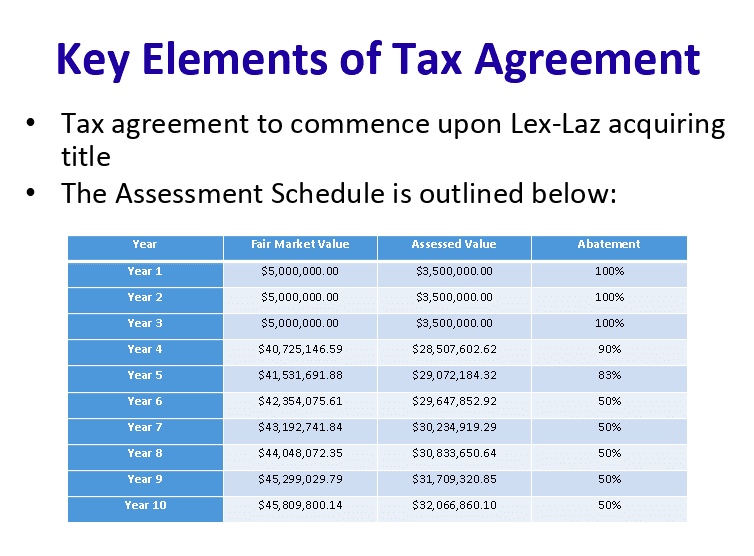

Under the approved tax stabilization agreement, LEX-LAZ will receive 100% abatement of real property taxes for the first three years, while the project is under construction, and then gradually build up to a 50% abatement in years six through 10. During the time of the abatement, Town Manager Matt Hart said based on an estimated mill rate the town will collect roughly $3.8 million of real property taxes.

Over the course of the 10 years, personal property and automobile taxes, which are not impacted by the abatement, will generate roughly $1.266 million in tax revenue to the town.

In year 11, when the agreement expires, One Park Road is predicted to generate $1.5 million in real property taxes and $1.91 million in personal property tax revenue to the town, while adding more than $35 million in total assessed value to the town’s grand list.

Courtesy of Town Manager Matt Hart

“This is the last straw,” Cantor said, for preserving and protecting the site’s history while welcoming new development in the Park Road neighborhood, the gateway to the town, and an area that is known for being unique, eclectic, and vibrant. “It’s up to us to protect it or not.”

It has been nearly eight years since the Sisters of Saint Joseph of Chambery, who have occupied the 22-acre property since 1898, determined they lacked a safety net and needed to downsize. They decided to seek development proposals for an “adaptive reuse of the property” that would preserve its historical elements and ensure a place for at least some of the Sisters to live.

The One Park Road development has been in the pipeline for many years, and has been approved by the Town Council in two separate incarnations. Two developers have attempted to obtain historic tax credits, but both were told that the project needed to be scaled back so significantly it would not be otherwise economically viable.

Rendering of One Park Road, viewed from the corner of Park Road and Prospect Avenue. Town of West Hartford website

Back in January 2016, the Council unanimously approved a Special Development District for the proposed Arcadia Crossing project, to be developed by Center Development Corporation at the intersection of Park and Prospect. Arcadia Crossing was to include 310 apartment units, 509 parking spaces including a 270-space parking garage, and a variety of common area amenities as well as a “west wing” – a 36-bedroom complex and other facilities for the Sisters of Saint Joseph – who would continue to own that property and live there for as long as they like.

Center Development Corporation was unable to secure funding for the project.

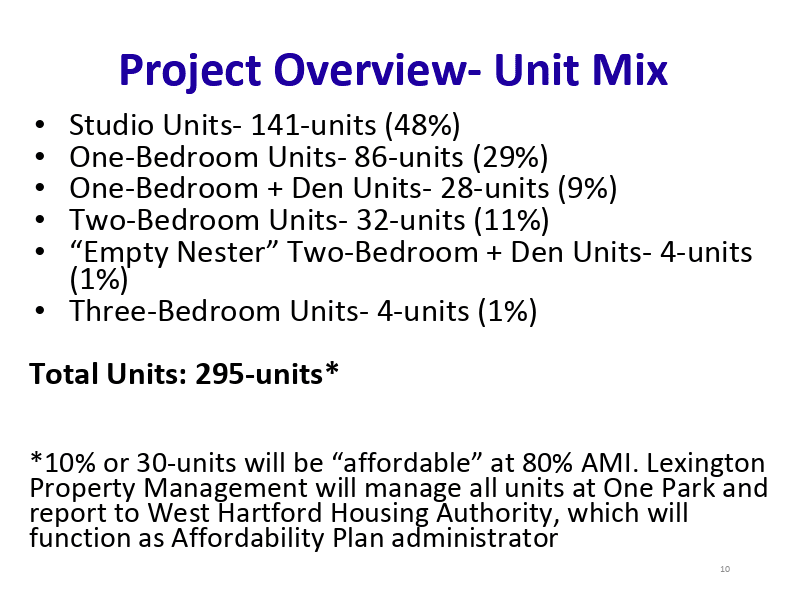

In January 2019, the Council again unanimously approved development plans for the site, based on a proposal from LEX-LAZ called One Park Road. The proposal was modified from what had originally been approved, with changes including fewer units (295 rather than 310) and the chapel as a more prominent feature.

The One Park Road project, designed by Amenta Emma, maintained and replicated many of the historical elements of the existing structures, with architectural design that also included some dramatic new elements – particularly in the main entry where a two-story glass curtain wall will framesviews into the interior courtyard where a fire pit will be incorporated into the existing boiler chimney. The former boiler room will be renovated to become the pool house.

LEX-LAZ designed their plans with the hopes of receiving historic tax credits and favorable financing, but “we got tripped up in Washington” with the National Park Service, Marty Kenny, president and principal with applicant Lexington Partners, LLC, [the “LEX” in LEX-LAZ; Alan Lazowski of LAZ Parking is the other partner], who submitted the application, told the Town Council’s Special Advisory Committee on Economic and Workforce Recovery at a meeting on June 29, when the abatement was first discussed.

LEX-LAZ was very optimistic about obtaining the historical credits, and spent a lot of time and money pursuing it, but was ultimately unsuccessful. The National Park Service would have requested further modifications to the property, reducing the size of the buildings and layout, to qualify for the historic credits, which would have then made the project not viable from a financial standpoint.

As the discussions were ongoing, LEX-LAZ helped the Sisters of Saint Joseph with some of the carrying costs for the building, and successfully obtained permission from the Vatican to reduce the purchase price for the property, said Kenny.

Representing the Sisters of Saint Joseph Wednesday night, Sister Barbara Mullen addressed the Council at the public comment session early in the meeting, passionately explaining how, with declining resources and membership, the Sisters had determined eight years ago that it would become increasingly difficult to properly maintain the sprawling property.

We “came together and knew we had to downsize our family,” she said. The Sisters are not paid by the church, but rather have supported themselves in careers like nursing or teaching.

Mullen said the NRRO – National Religious Retirement Office – annually looks at communities in terms of “funded-ness,” to determine if there is enough money to take care of members into the future. “They calculate the cost of care for every member who is above 70, and 70 of our Sisters are above 70,” Mullen said.

At the end of this year, NRRO told the Sisters of Saint Joseph that they would be 82.8% unfunded at the end of this year – “which means we do not have enough in our resources to take care of our 73 women until we are no more, until we have passed on,” said Mullen.

“If the sale of the property does not go through, we have to start the process all over again,” she told the Council, and they have been on the edge for eight years.

“We continue to age and our savings continue to dwindle,” said Mullen. “This would mean we can move forward with a little breathing space and a home,” she told the Council, and said the Sisters hope to be able to welcome their new neighbors and continue living their mission and being good stewards of their property.

“We think that the development that is being proposed will benefit the area and the Town of West Hartford,” said Mullen, adding that she hopes they enjoy their homes and the grounds as much as the Sisters have. “We pray that the development that’s on the ground now will move forward … for all whose lives will be influenced by what happens our property.”

Mullen was the only member of the public who called into the meeting to comment, but more than 20 area residents or business owners emailed the Council, expressing their support for the project and the stabilization agreement.

Hart told the Council that LEX-LAZ planned to seek further changes to the project last summer but determined that cutting back the size was just not viable, and late last year began discussions regarding a tax abatement in order to make up for the loss of an $8 million historic tax credit, while at the same time incorporating affordable housing that was not part of the original proposal.

LEX-LAZ estimated that the tax abatement would close the gap related to the loss of the historic tax credit and provide a rate of return estimated at 8.6 to 14% on the project, less than a desired return of 12-18% for this type of development, but enough to attract investment.

The tax stabilization agreement contains several key elements, Hart told the Council, including that LEX-LAZ must spend at least $66 million for the purchase of the property, and complete new construction of 230,098 square feet and renovation of 111,221 square feet of existing space, as well as the creation of 30,950 square feet of parking. The developer must commence construction within 12 months of the agreement, and reach substantial completion in 48 months – a duration that allows for a cushion.

The agreement also requires that at least 10% of the units be set aside as affordable, for individuals or families with incomes at a maximum of 80% of the area mean income. The West Hartford Housing Authority will administer the affordable housing rental process.

Courtesy of Town Manager Matt Hart

Consultant Goman+York, which completed a study of the agreement at the town’s direction, estimated that One Park will generate 126 jobs during construction and 20 permanent jobs, will add $1.464 million per years in new consumer spending in West Hartford and $3.415 million in new consumer spending outside of town.

The project will be a new source of affordable housing units, will enhance the area property values for residents and businesses, will preserve the historic chapel and 22 acres that includes large swaths of green space, and, Hart said, will allow some of the remaining 73 Sisters to maintain their residence indefinitely in the 36 units set aside for their use on the property.

Democratic Council member Liam Sweeney said this has been a long journey and he has been looking forward to this development as a “real bridge, a gateway” to create synergy and fill the gap between West Hartford and Hartford, near the new Parkville Market that has recently created a lot of energy.

“The idea that we would walk away from them in COVID is unacceptable,” Sweeney said, thanking Sister Mullen for sharing her story.

In addition, the 30 units of affordable housing would bring families to this town, “families can prosper, and develop, and change, and it changes the course of people’s lives. … I think this is a game changer for our town,” Sweeney said. “I know this is a change of what our policy is but as we all are seeing, change is a coming.”

Williams, who along with fellow Republican Fay voted against the proposal, said that while he wants to see the parcel developed the issue is also a larger policy decision.

West Hartford tells developers that the town does not offer tax abatements, and Williams said in the future there will now be the need to pick “winners and losers” when tax abatements are sought. “We are opening Pandora’s box,” he said.

Williams also said that agreeing to a tax abatement is an admission that the town’s budget trajectory is unsustainable, and is “resorting to treating symptoms” rather than fixing the problem.

Democrat Ben Wenograd said this is not a typical project, and what the Council has been asked to do is unique.

“This project is vitally important for the neighborhood,” Wenograd said, and would likely not go forward without the abatement as indicated by two attempts over the past few years. It will bring vitality and help not only the Park Road neighborhood but the nearby Park Street area of Hartford.

The open space and historic preservation make this an attractive proposal, and while another developer might have been able to do it for profit, the Sisters were not willing to compromise on maintaining the historical elements.

In addition, while even the affordable units will not be affordable to all, Wenograd said, “This is a great move forward on the need for affordable housing in this town.”

Fay said that while the project “tears at our heartstrings,” she is opposed to an abatement as a “slippery slope” and thinks there is a way to do the project without “sticking it to taxpayers.”

Deputy Mayor Leon Davidoff said he has been reflecting on the tax abatement issue and the viability of this project for the past few months.

“For 140 years, your organization has done things that many of us wish we could do on a daily basis … to help those that are the most vulnerable in our community,” Davidoff said, addressing his comments to Mullen and the Sisters of Saint Joseph. The doors have always been open, and during that time this parcel has never been on the tax rolls of West Hartford.

Now the Sisters have found themselves in a situation that is likely not unique to just their order. “How do you make ends meet when you have taken an oath of poverty?” The Sisters reside on the premises and don’t have another home.

Davidoff said that he is satisfied that all of the questions have been answered and due diligence has been done, and this decision is guided by reasonableness. In his votes on all of the town’s projects, he said he doesn’t have any regrets.

“This is an improvement in our town of $66 million dollars. Let me repeat, $66 milion dollars,” Davidoff said, and it’s been at least five years since the town has had such a large project to consider, and this will bring affordable housing, and foster economic and housing diversity.

“I think it’s transformative … bold, it’s visionary, and it demonstrates leadership,” said Davidoff. While approving an abatement may not be the course the town has taken in the past, it represents moving forward, helping grow the grand list, and allowing a new generation to call West Hartford home.

This is a policy decision, said Davidoff. “I think the best path forward is to be optimistic, to invest in the future, to go with the support of this project.”

Kerrigan called the project “disingenuous,” noting that it’s for those who earn 80% of less of the AMI, and not truly “affordable housing.”

Democrat Carol Blanks said while it’s a hard decision, “This development will greatly enhance our neighborhood. … I truly believe our town needs to grow our grand list and this is a prime opportunity.” She said she also sees it as a stepping stone to other development in the corridor.

“LEX-LAZ, in developing this property, is honoring the long and inspiring history of the Sisters of Saint Joseph and the historical site upon which they reside,” Minority Leader Lee Gold said.

The development will add vibrancy to an area of West Hartford outside of the Center, and a new workforce during as well as after construction, plus necessary affordable housing.

“This property is an otherwise minimally taxed parcel which will transform into a significant source of revenue for West Hartford. This tax stabilization agreement, coupled with more fiscal responsibility in addressing our town’s budgetary issues, is a necessary step in the process to ensure the continued stability of West Hartford,” Gold said.

Cantor thanked developers Marty Kenny and Alan Lazowski.

“This is a big deal, $66 million is a significant investment,” Cantor said.

She also thanked the Sisters of Saint Joseph for sticking with their commitment to their vision.”That’s one of the things that makes this different. It is not setting a precedent,” Cantor said, because it’s such a unique situation that can have tremendous economic impact on the gateway to the town.

“This is the definition of a transformative project,” Cantor said.

Following the approval of the tax stabilization resolution, the Council also voted 8-1 (Fay opposed) for a resolution authorizing Hart to conduct research and prepare policy recommendations for an affordable housing policy for West Hartford, something all towns are required by the state to have by 2022.

Hart’s findings and recommendations will be reported to the Council’s Community Planning and Economic Development Committee, and according to the resolution, “may include the strategic use of tax incentives, zoning incentives, a graduated permit fee schedule, and various forms of public-private partnerships.”

Like what you see here? Click here to subscribe to We-Ha’s newsletter so you’ll always be in the know about what’s happening in West Hartford! Click the blue button below to become a supporter of We-Ha.com and our efforts to continue producing quality journalism.

How does the Mayor intend to ensure that this is a “one-of-a-kind situation”?

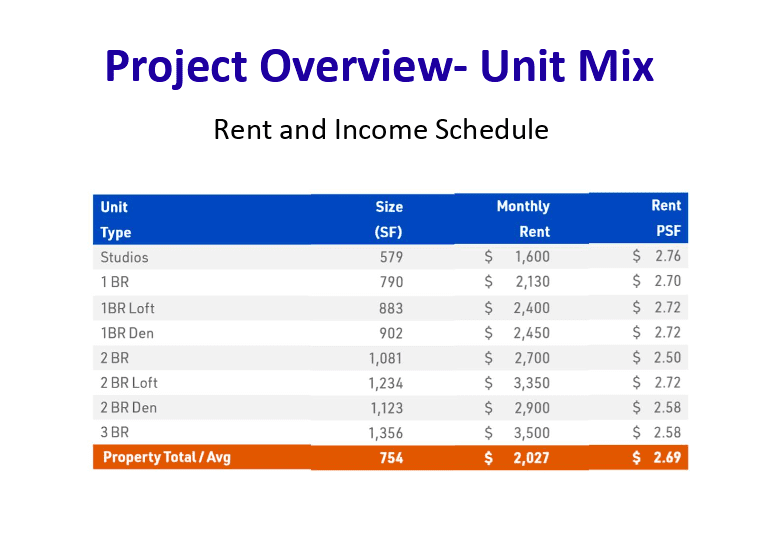

Where a small 450sf 1BR apartment is proposed to rent at $1000, the nearby rental properties, often in family owned 2-family buildings, will not be able to compete. My 2BR unit just a100 yards away from this property, around 1000sf, currently rents at $1300 per month, which is comparable to other units in this area. And we selected this neighborhood because it is one of the most affordable, for a 2 income family, in this town. This desperate proposal, coming on the heels of another myopic failure in the development of the Uconn campus on Trout Brook, is going to push us out and many other families out of town. Council needs to slow down on its grasping and agreeing to public-private deals that come at the expense of average families. What other deals will they agree to in the next 10 years as they search for revenue? Unfortunately, we were new to the area when this deal was coming on line, and we work full time and could not get involved in the public meetings, or we would have thought longer and harder about investing our time and energy in this neighborhood.

This is an amusing quote since only 40 total units are 2 BR + and can truly be considered real family options. Likely there will only be 3 units for affordable housing out of those 40 units so the rest would be forcing a family into studios or 1 br….

From the article: In addition, the 30 units of affordable housing would bring families to this town, “families can prosper, and develop, and change, and it changes the course of people’s lives. … I think this is a game changer for our town,” Sweeney said. “I know this is a change of what our policy is but as we all are seeing, change is a coming.”

Once again West Hartford subsidizes the risk of development through taxpayer sacrifice. If the development wasn’t economically viable without abatement, the developer has to change their own plans, not reach into my pocket.

[…] Read article here. […]

[…] at 345 Prospect Ave., however, which is located right across the street from what will be the new One Park Road apartment development (ground breaking should be in the next few weeks!). He said he has a few parties very interested […]