Debate Brews Over State-Level Child Tax Credit

Audio By Carbonatix

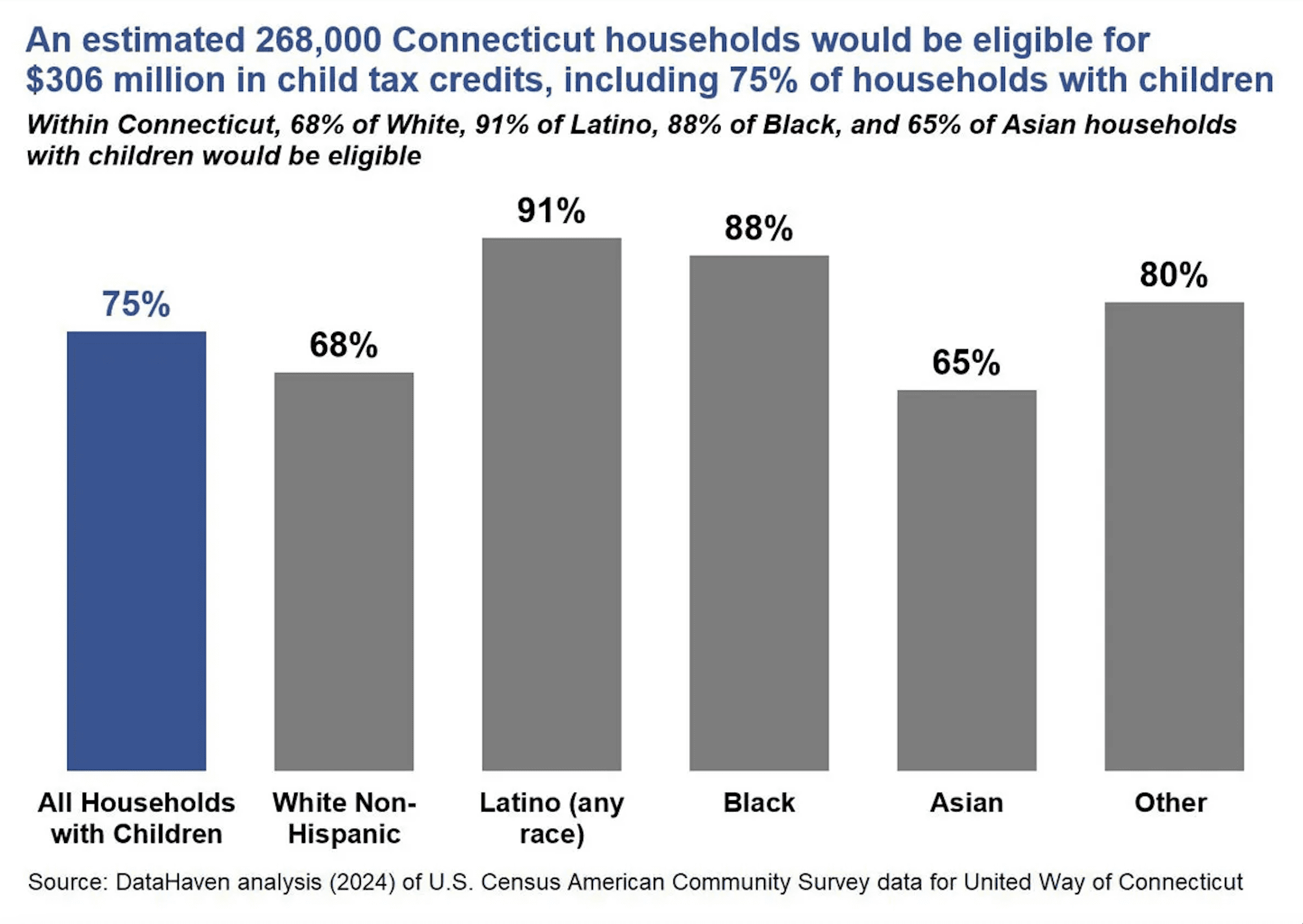

Distribution of Connecticut Child Tax Credit. (CTNewsJunkie image Courtesy of DataHaven)

Various pieces of legislation have been introduced to create a child tax credit this legislative session, and they vary in the amount a family would receive.

By Christine Stuart, CTNewsJunkie.com

Policymakers and advocates disagree on what, if anything, the Connecticut legislature should do after data from the U.S. Census showed child poverty doubled nationwide. But at least two organizations are making an argument with data to back their push for a state-level child tax credit to address the issue.

DataHaven and the United Way of Connecticut, analyzed the potential impact of a Connecticut Child Tax Credit (CT CTC) on local communities across the state. The findings of this aim to empower residents in discussions with elected officials concerning economic security, racial equity, and community well-being.

Click here to read the rest of the article on CTNewsJunkie.com.

Like what you see here? Click here to subscribe to We-Ha’s newsletter so you’ll always be in the know about what’s happening in West Hartford! Click the blue button below to become a supporter of We-Ha.com and our efforts to continue producing quality journalism.