West Hartford Grand List Increases Despite Change in Motor Vehicle Assessment Methodology

Audio By Carbonatix

West Hartford Town Hall in winter. Photo credit: Ronni Newton (we-ha.com file photo)

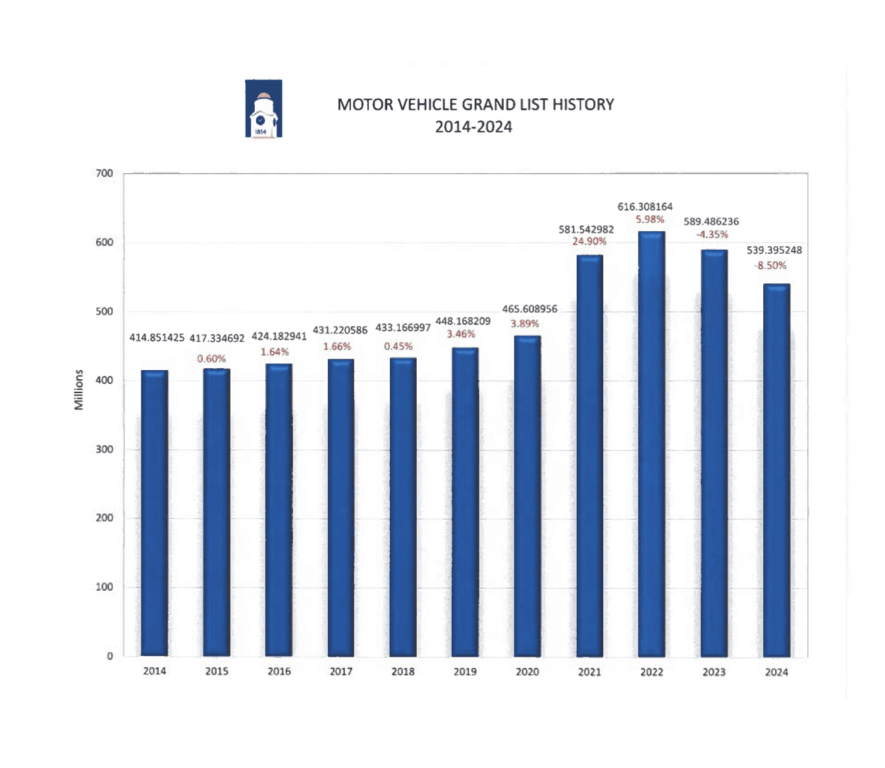

Changes in the method of calculating the value of automobiles led to a drop of more than $50 million in the most recent Motor Vehicle list.

By Ronni Newton

The 2024 Grand List has been finalized and submitted to Town Manager Rick Ledwith by Director of Assessments Joseph Dakers, and indicates an overall slight increase of $8,551,172, or 0.12%, with increases in real and personal property but a significant drop in motor vehicle values in comparison to the 2023 Grand List.

“The 2024 Grand List reflects West Hartford’s solid economic foundation and exciting new investments in residential, commercial, and industrial sectors that extend well into the next several fiscal years,” said Mayor Shari Cantor.

The 2024 Town of West Hartford Grand List, effective Oct. 1, 2024, which prior to action by the Board off Assessment Appeals totals $7,237,140,151 of net assessed value, was finalized in accordance with Connecticut General Statutes and reflects all changes in ownership and valuation, and will become the basis for taxation for Fiscal Year 2026, which begins July 1, 2025.

The 2024 Real Property list shows an increase of $46,265,212, or 0.7%, while the Personal Property list grew by $12,376,948, or 5.2%. The Motor Vehicle List, however, dropped by $50,090,988 – a staggering 8.5% decrease – offsetting a large part of the gains in other areas.

This is the second year in a row the Motor Vehicle list has shown a large decrease, although the reasons are different.

A year ago, when overall Grand List growth was just 0.08% in comparison to the previous year, growth in real and personal property was largely offset by a $26,821,928, or 4%, drop in the Motor Vehicle list. That drop was due to “corrections occurring in the automotive market,” Town Manager Rick Ledwith said at the time. The previous two years, a shortage of new cars being produced during the pandemic drove up the value of used cars, adding roughly $150 million in value to vehicles owned by West Hartford taxpayers.

The impact on the 2024 Motor Vehicle list resulted from a legislative change in the valuation of motor vehicles by all Connecticut municipalities. “The state-mandated shift from the National Automobile Dealers Association (NADA) valuation to the Manufacturers Suggested Retail Price (MSRP) methodology, which incorporates a depreciation schedule, has significantly impacted Motor vehicle assessments for every city and town in the state,” Ledwith said.

Dakers, in a memorandum that accompanied his submission of the the 2024 Grand List Report to Ledwith, noted the impact of the legislative change. “Connecticut Assessors are no longer allowed to use the JD Power ‘clean retail value’ as a starting point. Included in the legislation is a codified 20-year depreciation schedule applied against the ‘MSRP’ based upon the age of the vehicle up to twenty years old. Lastly, while a small portion of our list, this law exempts utility trailers used exclusively for personal purposes,” Dakers wrote. More than half of the increased value from the pandemic years has been clawed back over the past two subsequent years.

“Despite this adjustment, we remain a strong and growing community, with continued investment in residential, commercial and industrial sectors driving long-term economic stability, growth that we see continuing well into the next several fiscal years,” Ledwith said.

“While the new Motor Vehicle valuation change for all Connecticut municipalities is beyond our local control, West Hartford’s long-term stability remains strong as we continue to see significant growth in key areas that contribute to our overall prosperity,” said Cantor.

The growth in Real Property, reflects new commercial property under development. Many of the projects remain incomplete, the report noted, and they are valued according to their completion levels as of Oct. 1, 2024. The Byline at 920 Farmington Avenue (48 apartments plus commercial) and One West Hartford at 950 Trout Brook Drive (172 apartments plus commercial) continue to increase in value as the construction progresses.

Commercial property construction, renovations, and additions have added $34 million in value, according to Dakers. “A staple of our grand list growth continues to be homeowner residential renovation projects,” he added, including additions, finishing attics and basements, and updating kitchens and bathrooms.

Residential and condominium development that remain under construction have added incremental value, including nine condominiums at 409 Prospect Avenue, 11 Gledhill Lane and 2 Lilac Terrace, and several single family homes being built. The sale of a former parsonage at 139 Mountain Road makes that property now taxable, Dakers reported.

“A number of the projects the Council has approved would also be at the top of this list in the coming years, demonstrating that continued investment and growth we are experiencing,” Ledwith said, including the Residences at Heritage Park (1360 Trout Brook Drive) which will include 322 apartments.

One Park (295 apartments) is in the fifth year of a 10-year abatement agreement, but is already on the list of the Top 10 Highest Taxpayers in West Hartford, Ledwith noted.

The Personal Property list is related to the businesses that have physical locations in West Hartford, or businesses that lease, loan, or rent assets to a business with a physical location in West Hartford, according to Dakers’ memo. The current census is 2,702 businesses, an increase of 14 over the previous year. “West Hartford businesses continue to experience healthy investment in furniture, fixtures & equipment which surpasses annual depreciation on existing assets,” he noted.

Overall, West Hartford’s highest taxpayer is Connecticut Light & Power, now known as Eversource, valued at $65,207,270. Other top taxpayers include Blue Back Capital Partners LLC at $53,123,120; the Corbin’s Corner property at 1459 New Britain Ave. valued at $46,119,003; Westfarms, valued at $44,311,820; and Bishops Corner SC LLC (Albany and North Main) at $42,892,640.

Rounding out the top-10 taxpayers are Lex-Laz West Hartford LLC (One Park) at $29,943,924; Town Center West Associates (29 South Main St.) at $29,525,660; Steele Road LLC (243 Steele Rd.) valued at $28,586,920; ALNIC LLC (property occupied by Whole Foods at 50 Raymond Rd.), valued at $23,128,910; and ER West Hartford LLC (apartment complex at 1248 Farmington Ave.), valued at $21,136,690.

Preparation of the Grand List is one of the steps in the town’s budgeting process, and reflects the property values to which the mill rate applies. The current mill rate, as adopted by the Town Council in April 2024, is 42.35 mills for real and personal property, and for vehicles the mill rate is the state cap of 32.46 mills.

West Hartford’s budget for 2025-2026 (FY26) is scheduled to be submitted to the Town Council on March 11, 2025, and adopted in late April.

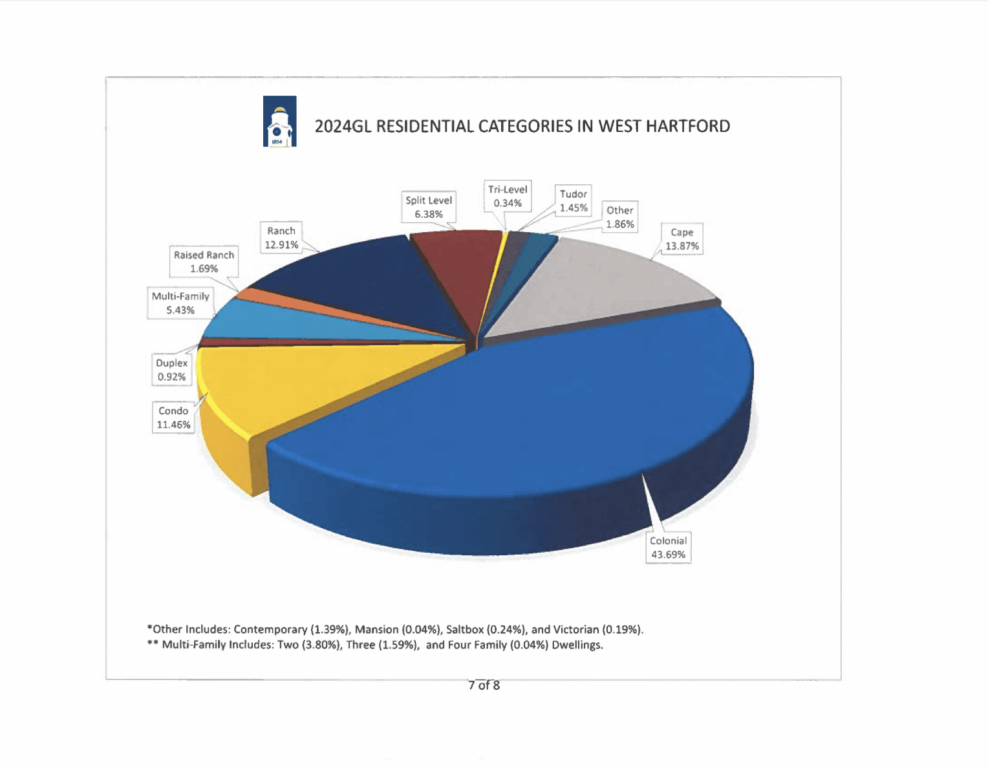

The following charts were submitted by Dakers to the Town Manager as part of his presentation of the Grand List.

Oct. 1, 2024 West Hartford Grand List residential property categories. Courtesy of Town of West Hartford

Motor Vehicle Grand List history. Courtesy of Town of West Hartford

Like what you see here? Click here to subscribe to We-Ha’s newsletter so you’ll always be in the know about what’s happening in West Hartford! Click the blue button below to become a supporter of We-Ha.com and our efforts to continue producing quality journalism.

This is an article full of clear information on the Town’s grand list. I loved the 2 graphics prepared by Joseph Dakers. It will help those of us still working to get more senior housing on one level.