West Hartford Town Council Approval of Fixed Assessment for Affordable Housing Project Nearly Unanimous

Audio By Carbonatix

900-904 Farmington Avenue will be redeveloped into the Camelot, which will be deed-restricted affordable housing. Photo credit: Ronni Newton

Following some spirited discussion, the West Hartford Town Council voted 8-1 Tuesday night to support the development of affordable housing at 900-904 Farmington Avenue through a plan to fix the assessment according to a 10-year schedule.

By Ronni Newton

A plan by WHI Camelot LLC to transform property currently occupied by the West Hartford Inn and the shuttered Los Imperios Restaurant into 44 units of affordable housing received strong words of praise and an additional boost from the West Hartford Town Council following a favorable vote on a plan to fix the assessment of the property for a 10-year period.

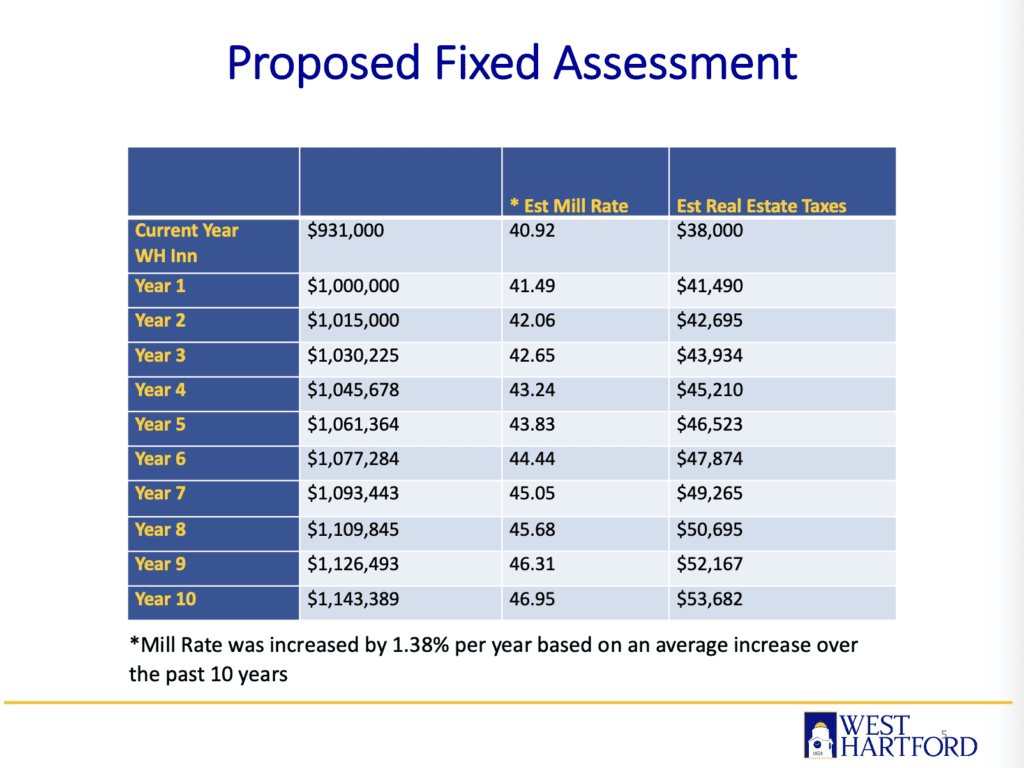

The Finance and Administration Committee met prior to regular Town Council meeting and the agenda included an in-depth review of the proposed resolution to allow the assessment of the property to be fixed at a value starting at $1,000,000 and increasing to $1,143,389 in year 10 for what will be known as The Camelot – redevelopment that includes adaptive reuse of the hotel and demolition of the former restaurant to accommodate new construction of additional residential units.

The vote was 8-1, with nearly every Council member voicing strong words of praise for what was referred to as a milestone project as well as enthusiastic support for the assessment fixing plan that will support a development that will now be 100% affordable and will still provide the town with more tax revenue for the property than is currently being received.

“Our team is extremely appreciative of the town’s consideration and approval of this agreement, and it is further evidence of its commitment to supporting the creation of housing that is affordable in this community,” Lewis Brown told We-Ha.com on Wednesday.

Brown is the founding member and managing principal of Honeycomb Real Estate Partners, a principal of WHI Camelot LLC, which is purchasing the 900-904 Farmington Avenue properties and together with his partners will redevelop the West Hartford Inn and former Los Imperios restaurant spaces into The Camelot, a 44-unit mix of one- and two-bedroom affordable apartments. Brown and Steve Caprio, Honeycomb’s Director of Development, are partnering with other local developers – Corridor Ventures, Vesta Corporation, and Joseph Vallone of Vallone Ventures – to transform what Lt. Gov. Susan Bysiewicz referred to earlier this year as an “eyesore in a really great place in West Hartford” – into much-needed residences for people at a variety of income levels.

Rendering of The Camelot. Town of West Hartford website (we-ha.com file photo)

What is the Tax Assessment Fixing Agreement?

“Before us what we have is something I think the town should fully embrace,” said Deputy Mayor Liam Sweeney, who also chairs the Finance and Administration Committee.

While Sweeney said the Council has talked about affordable housing and most newly-approved developments have included an affordability component – whether it’s “big A” or “little a” affordable – this project, which was originally proposed with four of the 44 units at market rate, is now going to be 40-year, deed-restricted 100% affordable, and located near the center of town, with access to transportation.

Twenty-two of the units will be “deeply affordable,” with 13 of the units – five one-bedroom units and eight two-bedroom units – available to those renters who qualify at the 30% AMI (area mean income) level. Nine units – five one-bedroom and four two-bedroom – will be at 50% AMI, and the remaining 22 units (10 one-bedroom and 12 two-bedroom) will be for those at 80% AMI, which is a level often referred to as “workforce housing.”

Sweeney highlighted three major reasons why The Camelot is good for West Hartford, including that redevelopment will eliminate a restaurant space that had for years created significant public safety issues for the neighborhood. Redevelopment will also eliminate an eyesore, he said. “The current establishment is not well kept,” he added, and the renovation and new construction, which will cost an estimated $26 million, will be a great addition to the community.

The third highlight, Sweeney said, is “the public good of having 100% affordable housing, true, deeply affordable housing, in an area that is becoming almost unaffordable,” is a major factor. The 40-year deed restriction will prevent the property from being anything other than affordable housing for at least the next four decades.

“This is not a tax abatement,” Sweeney said. It’s “predictable tax for the property owner.”

West Hartford has already invested close to $4 million in the property – $3 million through an affordable housing grant program established in late 2022 that uses a portion of the town’s American Rescue Plan Act money – and $998,000 for which the town received approval last year from the Connecticut Department of Economic and Community Development’s Municipal Brownfield Grant Program to assist with the remediation and environmental rehabilitation of the site which once housed a gas station.

The $3,998,000 is not a cash outlay, but rather loans which will eventually be repaid, Town Manager Rick Ledwith said.

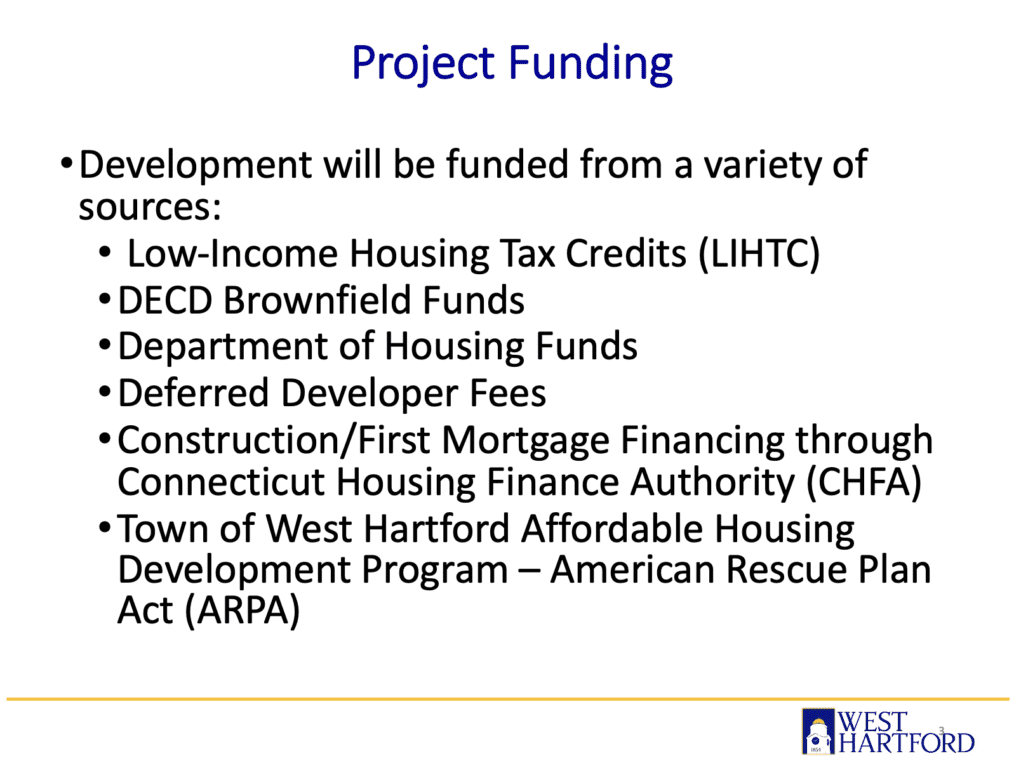

Creation of a capital stack with various financing options is key to making an affordable housing project economically feasible since the future rents can’t be set at a level sufficient to offset the development costs – particularly now that The Camelot will be 100% affordable.

“The project cannot be fully financed with the project funding sources identified previously,” Ledwith said. Fixing the assessed value will fill a gap and allow the project to move forward, and is an option that is permissible under section 12-65B of the General Statutes.

Courtesy of Town Manager Rick Ledwith

“This is a home run,” Sweeney said, and even with fixing the assessment, the town will collect more taxes than they have from the current owner, who has not improved the property since purchasing it in 2012.

“One in the hand is better than two in the bush,” Sweeney added.

Town Council input

Republican Mary Fay, the Council’s minority leader and also a member of the Finance and Administration Committee, said during the committee meeting that there had not been enough time to really understand the assessment fixing resolution, which was posted several days earlier as part of the Council’s agenda and the committee agenda. Ledwith, who said he had reviewed it with her by phone, provided a PowerPoint presentation Tuesday which illustrated an estimate of tax revenue for the property based on an average mill rate increase of 1.38% – which is the average mill rate increase over the past 10 years.

While the assessed value for the property will be fixed, whatever mill rate the Council adopts for that budget year will apply to that fixed value.

“Springing it on us is not the way to go,” Fay said. “Our job is not to enrich developers,” she said, during the committee meeting, adding that profit margin is definitely included in the plan.

Proposed assessment fixing and estimate of tax revenue for 900 Farmington Avenue. Courtesy of Town Manager Rick Ledwith

Fay questioned Ledwith’s statement that if the tax assessor valued the property rather than allowing the Town Council to fix the assessment it would be in the range of $3 to $5 million. Because of construction costs that she said were an estimated $26 million, she said she thought the assessment would be much higher, and the town would be missing out on the chance for much more tax revenue. Assessments for apartments, however, are not based on construction costs but rather on net operating income, and in this case rents are tied to the AMI. In fact, if the AMI drops, rents need to decrease as well, Ledwith said.

During the Town Council meeting, when all councilors shared comments about the project prior to voting, Fay – who thumped the table as she spoke – was even more adamant in her disdain for the plan.

“I am not against affordable housing. I grew up in a town that had a lot of it,” she said during the Council meeting, adding that she had friends who lived in affordable housing who are still her friends today.

She said that while she understand that financing affordable housing is not a simple equation, the assessment fixing is “not a good deal for the town.”

Fay said the town will be “settling for a pittance” in tax revenue for a property that she said would be worth close to $30 million.

“We are not making good decisions. … We can’t keep giving away taxpayer’s money,” Fay said. “I support affordable housing. I have supported affordable housing all my life … but if the developer can’t make it work maybe it’s not the best use,” she said, adding that she thinks “it’s time that we get our fiscal house in order.”

Sweeney, who had earlier corrected Fay’s assumption about the value of the property during the Finance and Administration Committee meeting, would not let that same statement become part of the record of the Council meeting, reiterating that without fixing the assessment, it would be a $3 to $5 million property, not $30 million.

“We are not losing money on this we are actually gaining money,” Sweeney said, challenging Fay’s statement. “If you’re going to start making things up … that is not correct, Mary,” he said, and she responded that “maybe this should not be crammed through.”

After several interruptions, Mayor Shari Cantor stepped in to quell the argument and clarify who had the floor.

Sweeney said the value of the property had been clarified during the Finance and Administration meeting, he wanted to be sure the facts were stated for the record, and questioned whether Fay actually supports affordable housing.

“This could be totally taxable,” Fay said. “I don’t like being responsible for our developer’s return,” she added, and you know it’s in there.”

There were a few questions from other members of the Town Council, but strong praise for the project and other than Fay all supported the resolution in the 8-1 roll call vote.

“I’m excited to see deeply affordable units,” said Democrat Deb Polun, including that more than half of the overall units are two-bedroom homes that can house families. “The assessment fixing before us is a key piece … a creative solution is not an abatement but will still allow us to receive property taxes on this land and at a higher rate than we currently receive property taxes for 10 years,” she said.

“Affordable housing is a unicorn,” added Polun, and it takes creativity and commitment in order to make sure that the project happens.

“We have been talking about affordable housing for a long time … and we all talk about what it is that is affordable,” said Democratic councilor Carol Anderson Blanks. This development will provide opportunity for people who want to live in West Hartford but find it too expensive, and in a location that has other nearby options available as income grows.

“It’s sort of like a stepping stone,” Blanks said, something to “embrace not only for the present but also for the future.”

Republican Alberto Cortes said this project is right for the town and he can’t wait to see it completed. “I came from affordable housing, I lived through it, lived around it,” he said, and he knows what it’s like when it’s done the wrong way.

“To see the list of where the funds come from it takes a village,” said Cortes. While it’s not perfect, he said, it’s a project that is worthy of support for the right reasons, and “it’s a good investment for the town.”

“One hundred percent affordable housing in the Center is a game changer,” said Democrat Tiffani McGinnis. “I grew up poor – ‘searching in the couch cushions poor,’” she said. She understands housing challenges and is proud that in West Hartford, we’re ”not only talking the talk but we’re walking the walk.”

Before voting in favor of the resolution, Republican Mark Zydanowicz made sure certain items were clarified for the record, including the AMI requirements which Ledwith confirmed were part of the submission to CHFA (the Connecticut Housing Finance Authority).

Zydanowicz also asked Ledwith where the specific fixed assessment values came from, and Ledwith said the model was built from a review of the pro forma for the project and reviewed by multiple parties. The agreement can’t be extended beyond 10 years, and he said around year five the Town Council will need to re-look at it to determine what may need to be done to continue to be done. “We will work with developer to make this viable for 40 years and beyond,” Ledwith said.

Democrat Ben Wenograd said he was “a little bit baffled” by some of Fay’s statements, and noted that you can’t compare 100% deed-restricted affordable housing unit to some of the other apartment buildings that are going up in town right now which can charge whatever rents “the market will bear.” In this case the rent is statutorily restricted by deed and can’t be adjusted by the market.

“If you are for affordable housing in this area,” he said, you need to approve the financing.

The state has a well-documented shortage of affordable housing, Wenograd said. “I am very proud of this town, because this project has not met any opposition … everywhere else this would be a big controversy,” he said. “Here in West Hartford we respect the value of this.”

Wenograd added that “this is a great step,” and while there have been small numbers of affordable housing added to recent proposals, this is much more. “This is really a tribute to staff, to this Council, to this town … I’m so excited to welcome our new neighbors that will be living there.”

In January 2023, Mayor Shari Cantor (right), Lt. Gov. Susan Bysiewicz (second from right), state Sen. Derek Slap, and members of the Town Council outside the West Harford Inn property speak about the brownfield grant that will help make The Camelot development of affordable housing feasible. Photo credit: Ronni Newton (we-ha.com file photo)

Cantor said that since becoming mayor seven years ago, she has been aware that there was a better use for the 900-904 Farmington Avenue property – affordable housing.

“This is monumental,” she said, providing a bit of background for how plans for The Camelot came to be.

Years ago she approached the West Hartford Housing Authority about it, but the property is a small parcel, encumbered by its proximity to a gas station and funeral home, and they couldn’t find a way to make it work – and if they had, she added, their model would have resulted in tax revenues lower than what will be generated through the assessment fixing plan.

The town has been actively looking for a developer for the parcel, and previously believed there would need to be market-rate units included to make it feasible. After COVID, the development landscape changed, and there are now many market-rate projects in progress in the area.

“And then this developer started to knock on our door and show some interest,” Cantor said. Lewis Brown and his brother grew up in West Hartford, attended nearby Morley School, and care deeply about West Hartford.

In fact, Brown previously told We-Ha.com that he and his brother celebrated their birthday parties at Pancho McGee’s – one of the restaurants that formerly was located on the property.

“I’d always driven by and thought it was an opportunity,” Brown said previously.

“There is such a big need for us to provide a variety of housing,” said Cantor, with strategic, well-thought-out development, noting that more than 20% of the West Hartford population is classified as ALICE – “Asset Limited, Income Constrained, Employed.”

“What this plan will do is create a neighborhood affordability and not create segregation,” Cantor said. “I see passion, I see real care and thought going into this project, this development … and I do believe that the state has provided the tools for us to put this together,” she said, and it’s up to the town to provide the last piece.

The community has been supportive of the development, Cantor said, ” and I am proud that we are in this place.”

At 100% affordable, the 44 units will provide a “significant jump for us in affordable housing stock,” Ledwith said.

Rendering of The Camelot. Town of West Hartford website (we-ha.com file photo)

Like what you see here? Click here to subscribe to We-Ha’s newsletter so you’ll always be in the know about what’s happening in West Hartford! Click the blue button below to become a supporter of We-Ha.com and our efforts to continue producing quality journalism.

When will the council focus on fixing town roads?

So going by the information presented solely in this article, the problem with the way the Proposed Fixed Assessment is presented in the slide – and something that would have likely helped bring resolution to Councilor Fay’s concerns – would have been to add years “11 and on” to the slide.

If the Town Council is providing a 10-year fixed assessment, and the property is deed-restricted for 40 years – then the life cycle of the project (the maintenance costs to keep the property in good condition in years 11-40) must be better represented and understood. Basically what happens in year 11? How significantly will the property taxes increase in year 11 based on the projected AMI (in 2033) and how is the Owner going to keep the units “affordable” given the projected property tax increase at this time? I would assume this would be included in the developers pro forma that was used to develop the agreed upon fixed assessment? Was any of this discussed at the meeting?

While I agree this property is an eyesore and redevelopment is beneficial, it is somewhat disingenuous for the Council to approve these types of projects under the assumption that “the Town Council will need to re-look at it [around year five] to determine what may need to continue to be done. ” What happens if the Council has bigger, more important issues to deal with in 2028? Full life cycle accounting should be transparent and done at approval so that the Town is not stuck with another problem / eyesore in years 11-40…

It would certainly be good to know if years 11-40 were talked about at the meeting rather than just the short term benefits of this project. Any additional information would be appreciated.

Hi Alex. There was discussion about the out years, and the type of support that might be needed in the future. There are deferred developer fees which are part of the funding now (a standard part of the funding for affordable housing) and those will no longer be part of the equation after 10 years from what I understand. ~Ronni