West Hartford Town Manager Proposes $308.6 Million Budget

Audio By Carbonatix

West Hartford Town Hall. Photo credit: Ronni Newton

Town Manager Matt Hart proposed a $308.6 million budget Thursday night that would result in a 3.25% tax increase, and the Town Council will meet over the next several weeks, and hold two public hearings, before deciding on the final spending plan and the ability to use American Rescue Plan funds.

By Ronni Newton

There was nothing “usual” about the adoption of West Hartford’s 2020-2021 budget – which happened amid the early days of the COVID-19 pandemic, during one of the Town Council’s first virtual meetings, several weeks after the initially-scheduled vote, and involved use of $1.5 million in fund balance – and while the town and the community as a whole have adapted to the past year’s unique environment to the best extent possible, the $308,620,511 proposed 2021-2022 (FY2022) budget proposed by Town Manager Matt Hart Thursday night still reflects some uncertainty.

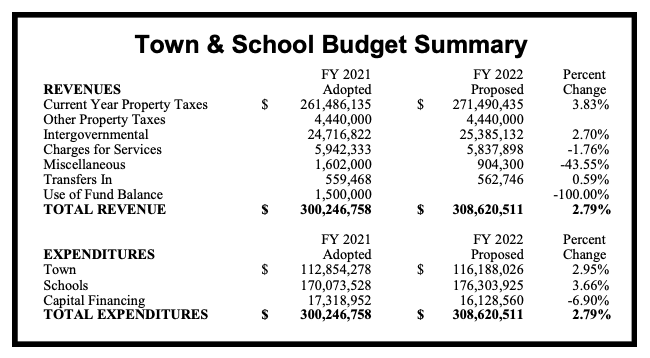

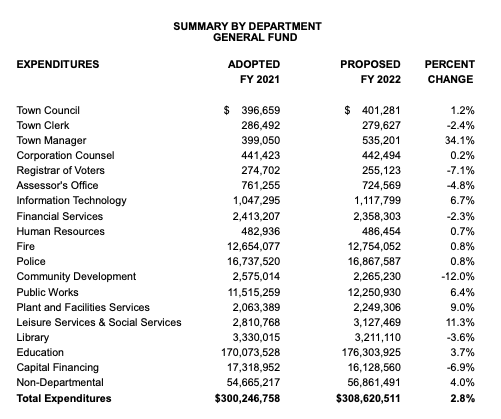

In comparison to the adopted budget for for FY2021, the proposed FY2022 budget includes an increase in spending of 2.79% ($8,373,753).

An overall increase in property tax revenue of 3.8% ($10,004,300) is needed to fund that spending plan, which will be partially offset by Grand List growth of 0.44% that will generate an additional $1,199,152 in tax revenue.

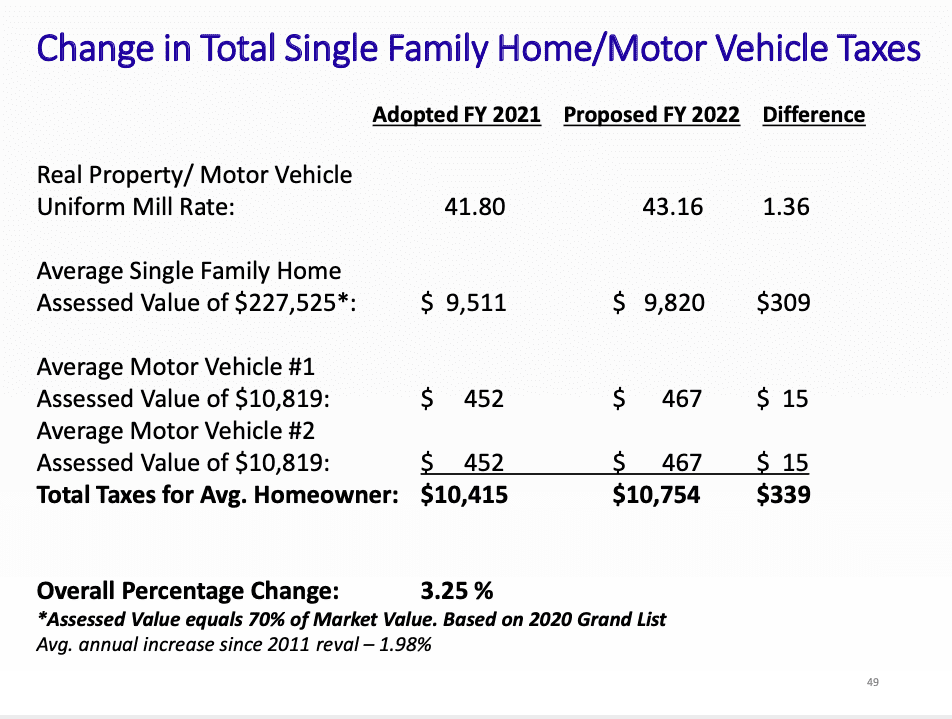

The resulting property tax increase Hart has proposed is 3.25%. The proposed mill rate is 43.16 mills. That mill rate, and the increase in expenditures, is less than what he originally proposed in March 2020, before the pandemic’s impact became more apparent and major budget revisions were made.

One very important factor impacting this budget is the use of fund balance. In FY2021 the Town Council approved use of $1.5 million in fund balance in order to keep the mill rate flat amid the pandemic. “I am not recommending that you do that again in FY2022,” Hart said Thursday.

American Rescue Plan Act

One of the biggest questions will be the nature of funding that the town is slated to receive directly from the $1.9 trillion American Rescue Act Plan which was passed by the U.S. Senate and U.S. House and signed Thursday afternoon by President Joe Biden. According to estimates provided to We-Ha.com by the Office of U.S. Rep John Larson, West Hartford will receive $24,828,317 in municipal aid and $10,321,000 in K-12 education funding.

The American Rescue Plan is “landmark legislation, approved by congress, supported by the president,” Hart said Thursday. And for local governments with a population of 50,000 or more, the money will go straight to the municipality for municipal as well as education needs.

The combined roughly $35 million can be used through 2024, but the town won’t just be able to appropriate a share of the funds to the operating budget each year.

“We are just learning about how this money can be utilized and we’ll be learning a lot more in the next several days,” Hart said. “The Treasury Department should be issuing guidance soon,” Hart said, information which will be very critical as the budget review progresses.

The funds are intended to respond to the public health emergency caused by COVID-19, including providing assistance to households, small business, and nonprofits.

It will provide premium pay – but Hart said he doesn’t yet know if that includes overtime – to those performing essential work.

Funds can also be used for providing municipal services that have been impacted by lost revenue – such as losses in parking fund and leisure services.

Investment in water, sewer, or broadband infrastructure can also be made using the American Relief Plan funds. “This could be very relevant to West Hartford,” Hart said.

Funds cannot, however, be used to shore up a pension fund, or offset a cut in municipal taxes.

“We are looking forward to receiving guidance on the use of funds for local government under the American Rescue Plan,” Hart said in the introduction to the budget document, noting the funds the town is expected to receive. “We are optimistic that we will be able to use this funding to alleviate pressure on the operating budget, to make important capital investments, and to otherwise support our community,” he said.

A look back

“What a year it’s been,” Hart told the Council. “I’m extremely proud of how we have worked as a town government under your leadership and as an organization to respond to the needs of the community.”

In his executive summary to the budget, Hart stated: “As the COVID pandemic raged, the Town continued to provide the highest level of services possible. Hard fiscal decisions were made but the primary focus was on the well-being of Town residents and Town staff. The fiscal year 2022 budget that is presented, continues to maintain that high level of services while limiting the property tax increase only to a level necessary to properly and adequately continue to provide those services.”

Hart highlighted unique and creative ways the town has been providing customer service over the past year, such as the library’s curbside pick-up. He also mentioned how West Hartford has found ways to conduct school and school-related activities in a creative manner, has continued food pantry operations, has supported COVID testing and vaccinations clinics, and has provided support for the business community.

“One of the things we’re most proud of is the outdoor dining experience,” he said, and that’s something the town is looking to replicate in 2021. The Connecticut Chapter of the American Planning Association recently gave the town an award for its expanded outdoor dining.

Despite the pandemic, 61 new businesses opened and four major residential developments are either underway or about to begin.

Hart also noted the many goals achieved by the Council and the town this year, including reviving the Commission on the Arts, establishing advisory groups for sustainability and affordable housing, the partnership between Interval House and the West Hartford Police Department, and authorizing the sale of Pension Obligation Bonds.

The pandemic as well as Tropical Storm Isaias had major impact on the town’s operating budget, Hart said. While just over $1 million in COVID costs have been reimbursed through CRF Funds, Hart said the town is still anticipating $470,000 outstanding reimbursement from FEMA for COVID as well $471,430 from FEMA for Isaias. In order to be conservative, those FEMA reimbursements have not been included in next year’s budget.

The budget ultimately passed by the Town Council last May, was a $300,246,748 spending plan, an increase of $3,753,192 or 1.27% over the FY2020 budget. The mill rate remained flat at 41.8 mills.

Town Manager Matt Hart’s original FY2021 budget proposal, which he delivered on March 10, 2020, was roughly $308.7 million, which would have been an increase of $12.2 million or 4.12%. Amid serious concerns about the economic impact of the COVID-19 pandemic that arose over the subsequent weeks as the state went into lockdown, Mayor Shari Cantor and other Council members had tasked Hart and town staff with revising the budget so there would not be a tax increase. That was achieved in part with hiring lags, reductions in overtime, and moving two police officers from the General Fund back to the Parking Fund to reduce the budget. The Council also approved use of $1.5 million of the town’s surplus.

Hart also explained the difference between the adopted FY2021 budget and the FY2021 “adopted amended” budget – which included a supplemental appropriation of $1,742,211 on the town side and $2,300,000 for the Board of Education budget. Superintendent of Schools Tom Moore presented his budget last week as a comparison to the adopted amended budget, but Hart has based his comparisons on the adopted budget, which indicates an increase in education costs of 3.66%.

In comparison to the adopted amended budget, the increase on the town side would be 1.38% rather than 2.79%.

Looking ahead

The budget is a tool for the community’s recovery from the pandemic, Hart said.

“West Hartford is consistently recognized as one of the nation’s premier communities,” he said, and the town’s municipal services and programs are essential to maintaining the quality of life.

The Capital improvement Program is also a critical tool to make strategic investments in infrastructure.

How is the spending plan funded?

“As is true for the vast majority of Connecticut municipalities, we receive the bulk of our revenue from property taxes,” Hart said.

In addition to the 88% of revenue received from property taxes, the town receives intergovernmental revenue from the state, roughly 8% of overall revenue. That intergovernmental revenue could change dramatically, however, depending on the use of the American Rescue Plan funds.

“What we have included in the proposed budget is what the governor has proposed,” Hart said. While Educational Cost Sharing (ECS) – the largest piece of state aid received by West Hartford – is remaining flat according to the proposed two-year budget released by Gov. Ned Lamont in February, an increase in roughly $668,000 in payment in lieu of taxes (PILOT) funding is likely to be approved by the legislature and is included in the budget

The town does not plan to utilize any part of its undesignated fund balance to balance the FY2022 budget.

While West Hartford Public Schools will be receiving roughly $2 million in ESSER II funds (Emergency and Secondary School Emergency Relief) in the next fiscal year, those monies are going direct to the district, and “cannot be used to supplant regular spending,” Hart said. ESSER II funds are not included in the FY2022 budget.

How will it impact me?

The proposed mill rate for FY2022, a uniform rate for real/personal property and motor vehicles, is 43.16, an increase of 1.36 mills from FY2021.

According to Hart’s analysis, the average homeowner with two vehicles will see taxes increase by $339, or 3.25%, (from $10,415 to $10,754) for FY2022. In West Hartford, the “average” homeowner based on the 2020 Grand List has a home assessed at $227,525, and two vehicles assessed at $10,819 each.

What were the town manager’s goals for this budget?

“Management has structured the Proposed FY 2022 Budget in an effort to strike a balance between maintaining current services and increasing the tax burden, as we are cognizant of the financial strain that tax increases impose on our residents and commercial property owners,” Hart said in his executive summary.

The budget contemplates maintaining the undesignated fund balance – which had been at 9% prior to the reserving of $1.5 million to be used to balance the FY2021 budget and mitigate the burden to taxpayers amid the pandemic – at its current level of 8.5%. The $1.5 million has not yet been expended, but if the town does need to use it, Hart recommends a gradual building up of the reserve back to 9%, a level which is important to the bond rating agencies.

Hart noted that the forthcoming sale of up to $365 million of Pension Obligation Bonds this spring, approved through an ordinance passed by the Town Council in January, will increase the Pension Plan’s funding ratio to 100% as of July 1, 2021. At that same Jan. 26, 2021 meeting, the Council approved establishment of a Pension Bond Reserve Fund to mitigate the risk of economic downturn and spikes in annual Actuarially Determined Employer Contributions (ADEC). That reserve will be established at $26,919,077 – the amount set aside in the FY2022 budget for ADEC.

How is the budget allocated, and where are the increases?

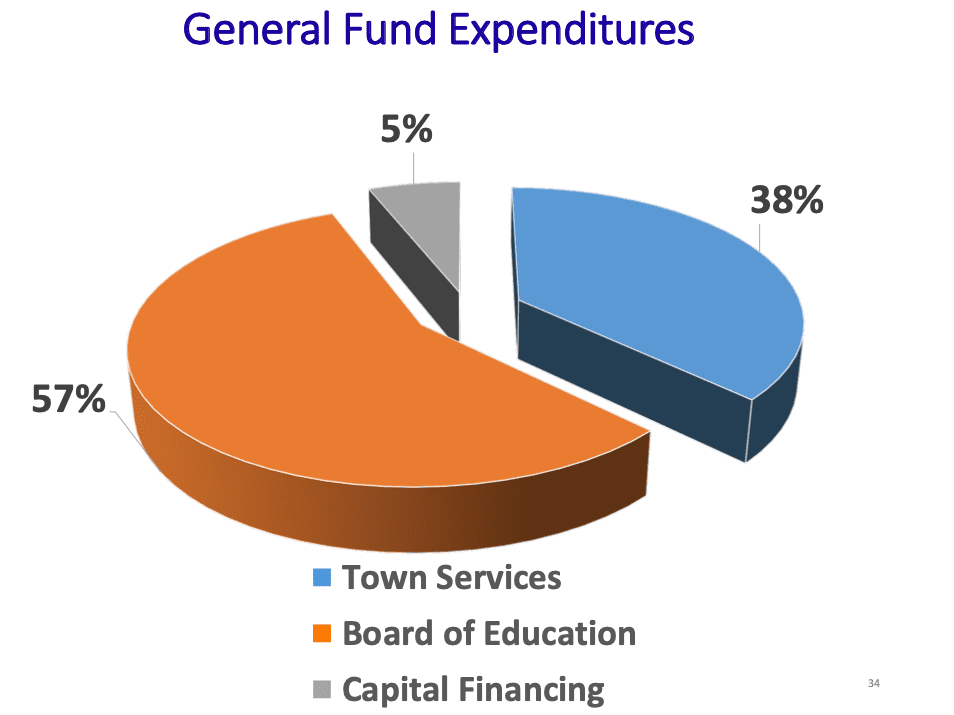

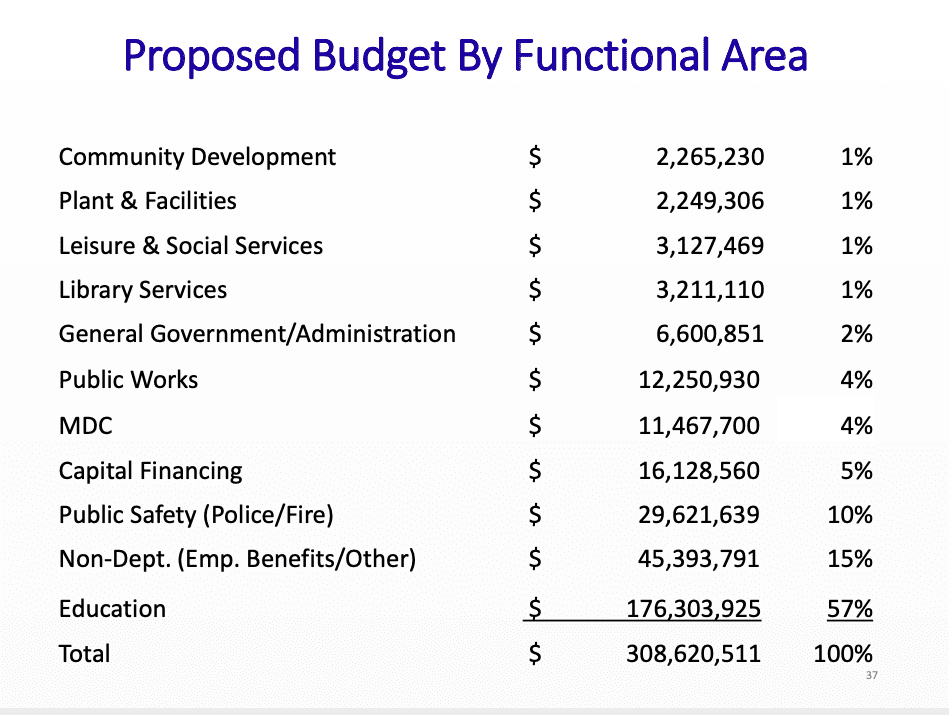

The 2.79% increase in the spending plan is spread among town services and education funding. Increases are partially offset by a decrease in capital financing cost.

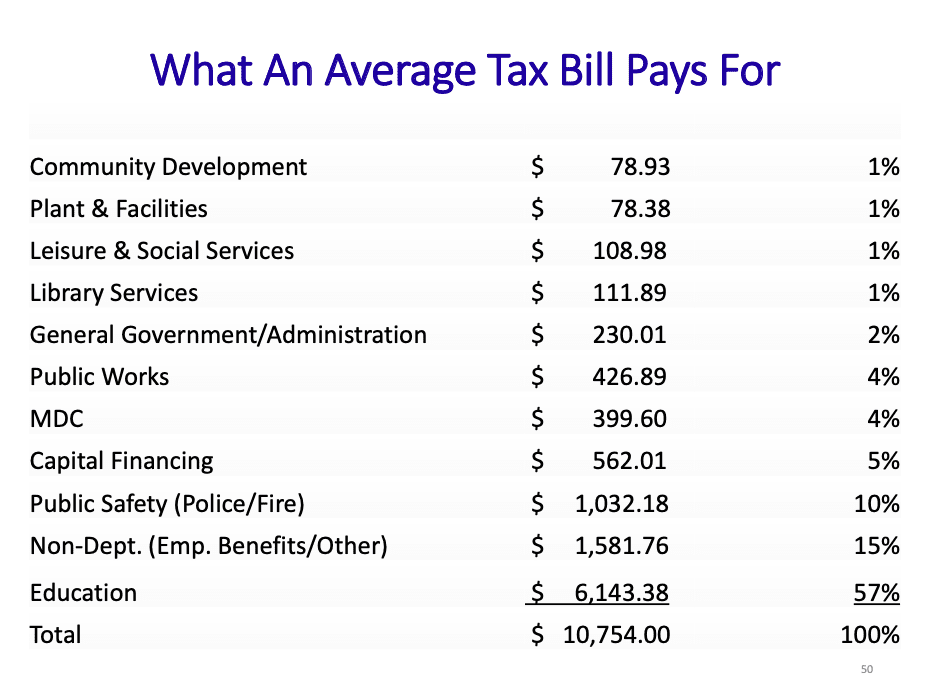

Expenditures for town services, which account for 38% of the total budget, are proposed to increase $3,333,748, or 2.95%.

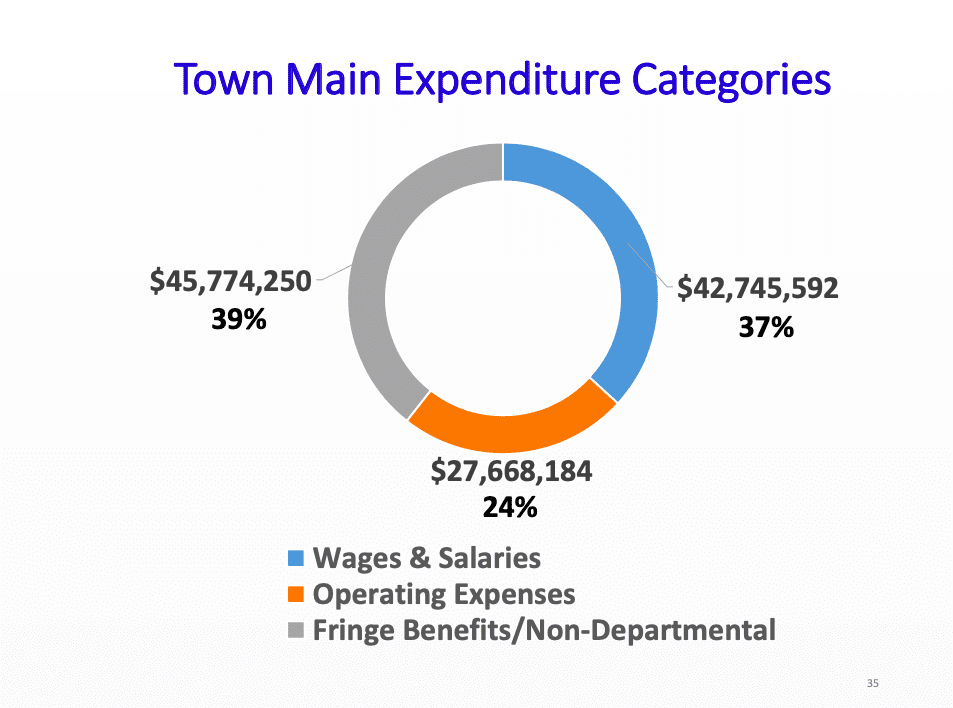

Of the town services portion of the budget, salaries make up 37%, fringe benefits and insurance are 39%, and operating expenses are 24%.

Temporary/part-time payroll expense will increase by $269,131 over last year because the town is anticipating that all municipal pools and other programming, including library and senior center services, will be restored during FY2022.

Other cost drivers reflected in the municipal services portion of the budget include the increase to ADEC to the Pension Fund ($1.1 million), an increase of $417,200 municipal solid waste and recyclable material disposal, contractual increases for various service contracts ($120,879), an increase of $829,261 in contingency costs for unsettled labor contracts, an increase of $465,493 for health insurance and workers’ compensation insurance programs, and a contribution of $485,000 for Capital Non-Recurring Expenses (CNRE).

“This is a very lean, perhaps the leanest in recent memory, CNRE budget,” Hart said. “The only things that are in that proposal are body cameras for our police officers as well as some smaller pieces of fire and rescue equipment. Everything else our directors submitted is on hold.” In the past, the town has been able fund CNRE through surplus, but that is not anticipated for this fiscal year.

One expense that has traditionally been a cost driver is the town’s required ad valorem tax paid to the Metropolitan District Commission for wastewater service. That tax will actually decrease by $388,700 for FY2022, Hart reported.

Funding for education is approximately 57.1% of the town’s budget, and the proposed budget submitted last week by the superintendent to the Board of Education would increase spending by 3.66% ($6,230,397).

Pre-K through grade 12 educational costs are the majority of the budget costs in most Connecticut towns. West Hartford has been consistently at about 57% in recent years, but in smaller towns it can be a much higher percentage, as much as 80-85%, Hart said.

Negotiated salaries, employee benefit expenses, and pension costs are major drivers of the education budget. The costs related to special education, including transportation and tuition for outplaced students, are are also among the primary costs driving the proposed education budget increase.

Hart said that he does not personally have discretion to adjust the superintendent’s budget, and while the Town Council can change the overall appropriation to the Board of Education, it cannot make line item changes.

The capital financing portion of the budget for both municipal and education services is roughly 5% of the overall budget. The total of $16,128,560, represents a decrease of ($1,190,392) or 6.87% from the current plan.

Capital Improvement Program

Along with the General Fund budget, the Town Council will review a 12-year Capital Improvement Program (CIP) for planning purposes, and will vote on a two-year Capital Improvement Program totaling $57,836,000.

Key projects over the next two years include the the Fern Street bridge replacement, Sedgwick Road pavement rehabilitation project, interior and exterior school and town building upgrades, street resurfacing, and design work for storm water management. The second year of the CIP also includes the start of the elementary school air quality project. The Board of Education voted to accelerate its original plan from 20 years to 10 years, but Hart opted to compromise on a 15-year plan in his proposed CIP.

The town is also planning to complete two long-planned projects over the next two years: construction of a new animal shelter and a new police department shooting range.

Grant funding is not shown in the CIP, and the possibility of using of American Rescue Plan Act funds, could result in changes to CIP plans.

The CIP also contemplates spending $6,000,000 over the next two fiscal years on a “project to fund the acquisition of a strategic property in Elmwood to serve as the site of a new community/cultural center and library branch. The project would provide us with the opportunity to consolidate most of our Elmwood-based assets in one location, and to repurpose some of our existing assets for re-development and grand list growth.” Hart said further details will follow.

What’s next

“I think we’re making very good progress,” Hart said. Over the next few years he said he expects to see growth in the Grand List through the 2021 revaluation as well as from economic development projects in the queue.

“We’re turning the corner on some of our major cost drivers … we’re not the Titanic but we’re a big ship,” he said, noting initiatives like the Pension Obligations bonds, changes in the health insurance plan and separate pay for newly-hired employees that are beginning to have impact, and energy savings.

Other things on the horizon include discussions about waste management that are taking place at the state level and the ongoing MDC active user fee survey which could reform the ad valorem tax.

“We will likely see some good revenue growth in years to come, and we are turning the corner on those cost drivers,” Hart said. Hart said it took a lot of work to keep the budget increase to a minimum.

“What we presented to you this evening we think is a very responsible budget consistent with our tradition of financial management excellence,” he said.

What we do “is absolutely critical to the quality of life,” Hart said, and will allow the town to continue to stand apart. West Hartford has full service public safety, a full service fire department that can respond in a few minutes, a skating rink, aquatics center, Rockledge golf course, multiple parks.

“Quality service plus prudent financial management – those things lead to quality of life and return on investment … for our businesses and our taxpayers.”

The Council will be meeting as a committee of the whole to review the budget in great detail over the next several weeks.

The public will have the opportunity to comment on the budget at public hearings scheduled for Tuesday, March 30 at 2 p.m. and Thursday, April 8 at 6 p.m. Both hearings will be held virtually.

Upcoming public meetings related to the Board of Education budget include:

- Budget Workshop No. 1, Wednesday, March 10, 7 p.m.

- Board Public Hearing, Wednesday, March 24, 7 p.m.

- Budget Workshop No. 2, Wednesday, March 24, following Public Hearing

- Board Budget Adoption, Tuesday, April 6, 7 p.m.

The detailed budget is available on the West Hartford Public Schools website. Suggestions can be sent to [email protected].

The Town Council is scheduled to adopt the budget on Thursday, April 22, 2021. That meeting will begin at 7 p.m.

All budget documents will be available for review Friday, March 12 on the town’s website.

The “Budget in Brief” can be found as a PDF below.

Like what you see here? Click here to subscribe to We-Ha’s newsletter so you’ll always be in the know about what’s happening in West Hartford! Click the blue button below to become a supporter of We-Ha.com and our efforts to continue producing quality journalism.

Loading...

Loading...